Retirement planning and saving are essential for all individuals. In India, schemes like NPS and APY help in planning long-term retirement savings. The PRAN Number is a permanent, unique identifier that keeps all pension-related activities under one account. From monthly contributions to investment performance and withdrawals. Everything is tracked through this unique number. Here, in this guide, you will learn everything about this unique identifier.

What is PRAN Number? (PRAN Number Meaning)

PRAN number full form is Permanent Retirement Account Number. It is 12 12-digit unique identifier issued to individuals enrolled in:

NPS (National Pension System)

APY (Atal Pension Yojana)

This number has lifetime validity and helps track all pension-related activities that include contributions, withdrawals, and growth. In simple terms, it is like a UID for a pension account. This number is essential for individuals participating in NPS or APY to manage their pension funds, check their balance, make contributions, and receive updates on their retirement account.

Automate your KYC Process & Reduce Fraud!

We have helped 3000+ companies in reducing Fraud by 95%

What is the PRAN Number in NPS?

In NPS (National Pension System), the PRAN number is the identity of an NPS subscriber. It helps subscribers track NPS contributions, transactions, and account details. It links both Tier 1 (mandatory retirement account) and Tier 2 (voluntary savings account). Through the PRAN, the system maintains a consolidated record of:

- Monthly or voluntary pension contributions

- Investment details across different pension fund managers

- Returns earned on investments

- Nominee details and withdrawal requests

What is the PRAN Number in APY?

In Atal Pension Yojana, PRAN refers to the 12-digit number allotted to every APY subscriber at the time of enrollment through a bank or post office. This unique identity helps track monthly contributions, government co-contributions, and the accumulated pension amount. Apart from this, subscribers can easily check account status, contributions, and ensure accurate pension payout tracking at retirement.

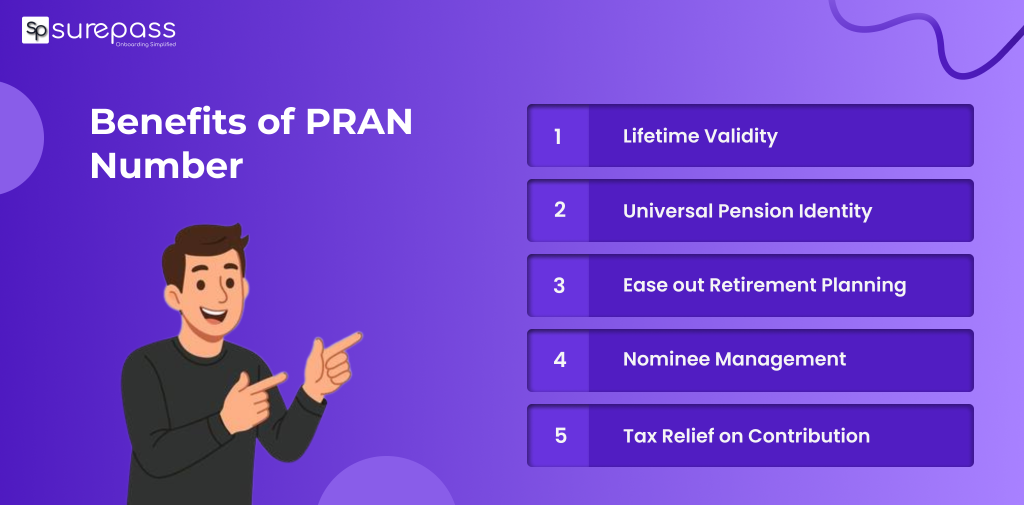

Benefits of PRAN Number

These are the benefits of having a Unique Permanent Account Number:

- Lifetime Validity: PRAN serves as a unique, permanent number that has lifetime validity.

- Universal Pension Identity: Whether you change jobs or move cities, the PRAN remains the same. It helps in pension management without interruption.

- Easeout Retirement Planning: PRAN helps in planning your pensions effectively by giving a clear view of the accumulated retirement savings and projected benefits.

- Nominee Management: It helps you designate or update nominees for your pension account.

- Tax Relief on Contribution: The contributions linked to your PRAN are eligible for tax deductions under relevant sections of the Income Tax Act. It makes the tax-efficient retirement saving options.

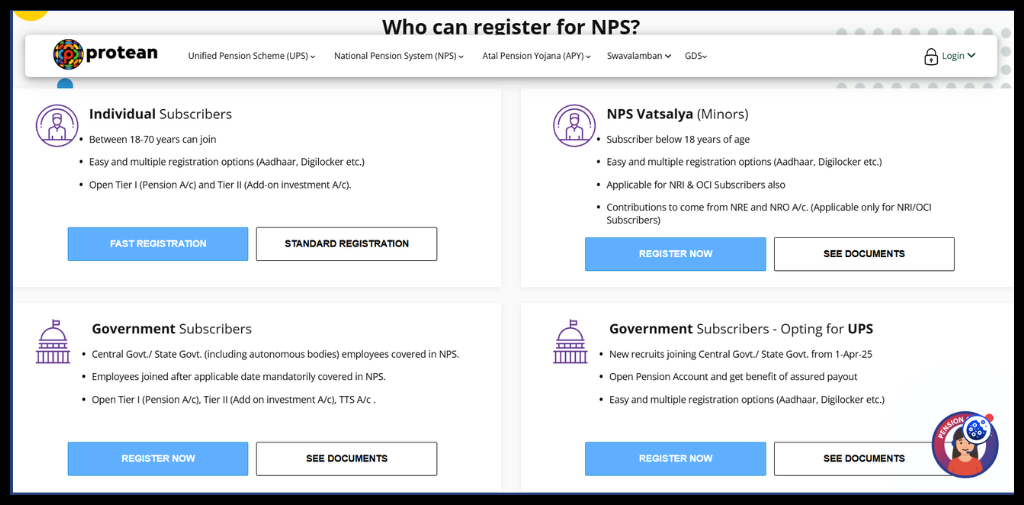

Who is Eligible to Apply for a PRAN Number?

The eligibility depends on the type of scheme:

For National Pension System (NPS)

- Individuals who joined the Central Government service from 1 January 2004.

- State Government Employees who opt for NPS.

- Private Sector Employees whose employers contribute to NPS.

- Self-employed professionals and individuals who voluntarily wish to invest in NPS.

- Residents, NRIs, and OCIs aged between 18 to 65 years.

Atal Pension Yojana (APY)

- Indian citizens aged 18-40 years

- Must have a savings bank account

- Subcriber must not already be receiving a pension

- An individual can voluntarily join and contribute regularly to receive a guaranteed monthly pension after the age of 60

Documents Required for PRAN

You need the following documents to apply:

- Aadhaar Card

- PAN Card

- Bank account details

- Photograph and signature

- Proof of Address

How to Apply and Get a PRAN Number?

You can apply for a PRAN number both online and offline.

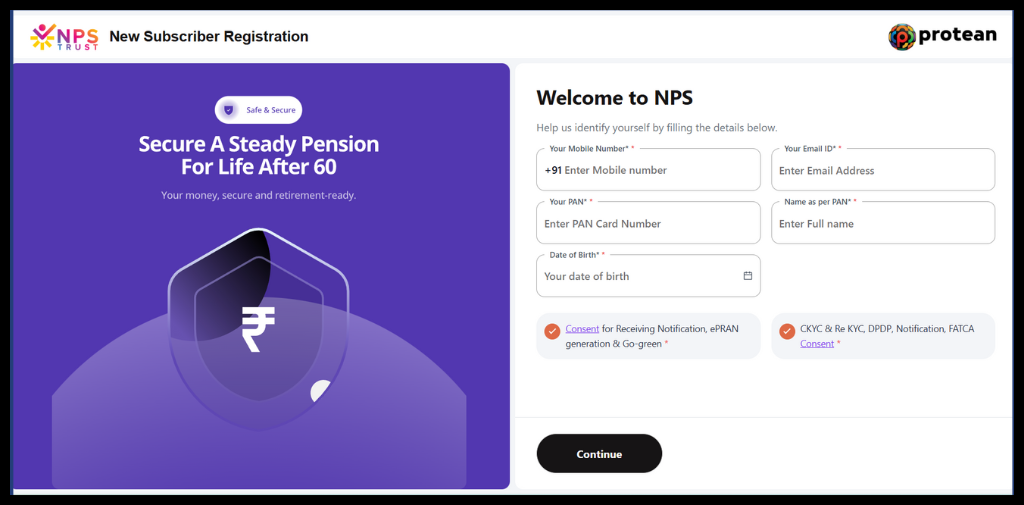

Online PRAN Application

- Visit the eNPS Portal.

- Choose the right subscriber option and click on Register Now.

- Enter the required details. Fill in the asked details and click on confirm.

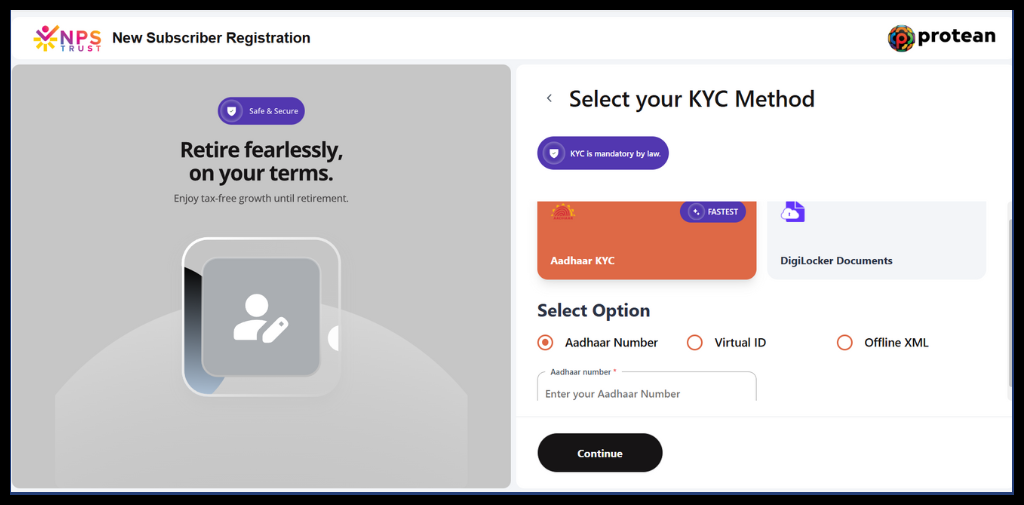

- Select the KYC method.

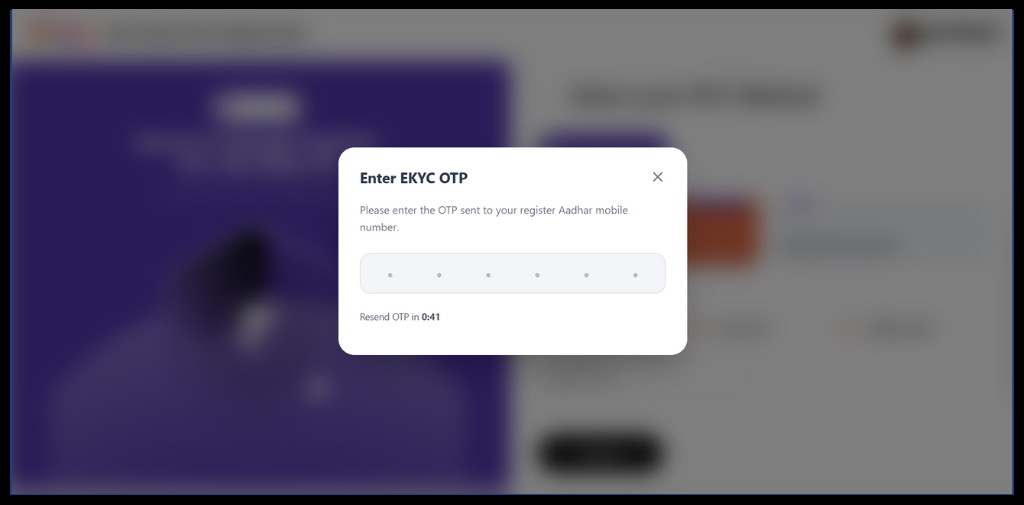

- Continue with OTP Verification.

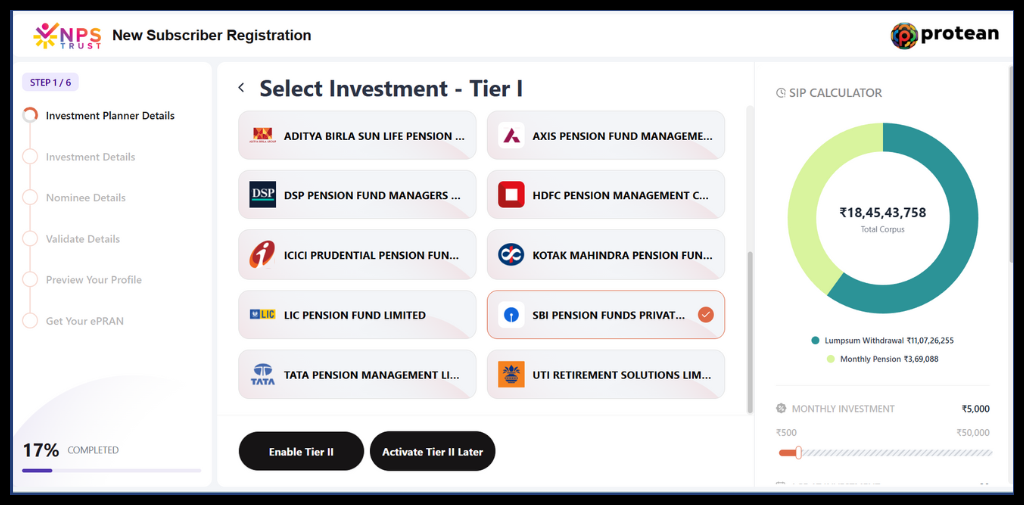

- Select the investment option and click on enable.

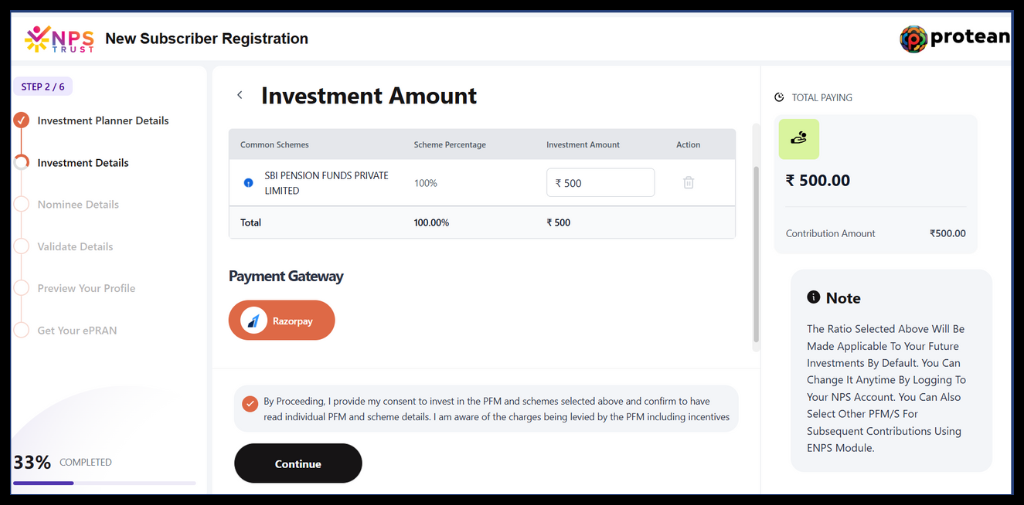

- Choose the investment amount.

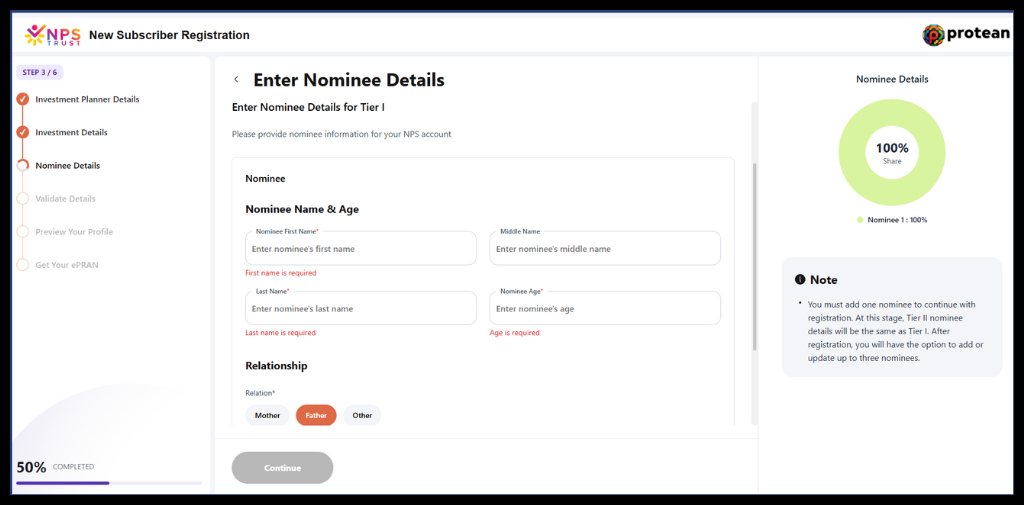

- Enter the nominee details.

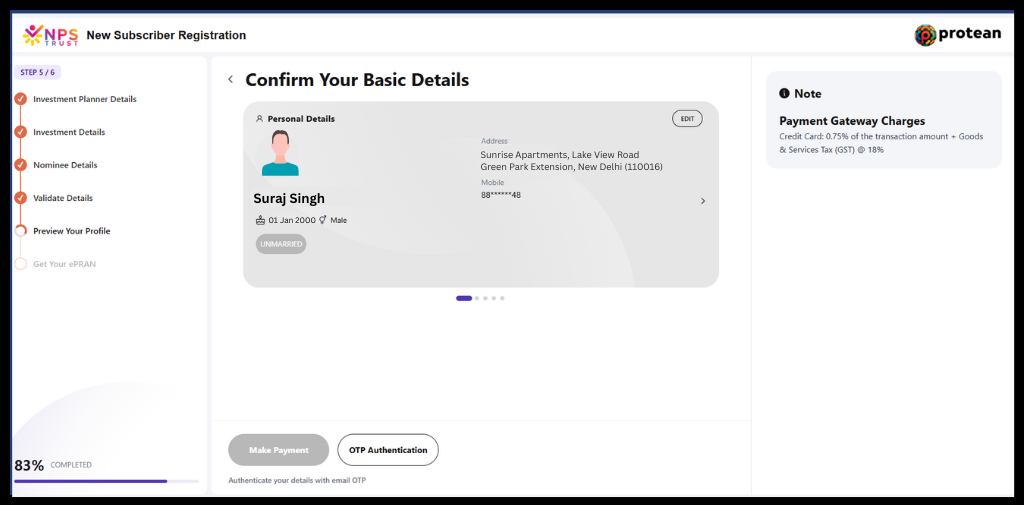

- Review the details, proceed with payment, and get the PRAN Number.

Offline PRAN Application

- Visit a bank, financial institution, or POP-SP registered under NPS/APY.

- Fill out the Subscriber Registration Form (SRF).

- Submit required documents (Aadhaar, PAN, photo, signature).

- The bank/POP-SP forwards your application to CRA.

- You will receive your PRAN number and card via post.

Are PRAN and PAN Numbers the Same?

No, PRAN and PAN numbers are not the same.

Purpose

- PAN (Permanent Account Number): It is used for income tax, financial transactions, and identity verification.

- PRAN (Permanent Account Number): It is used to manage and track pension accounts under NPS and APY.

Issuing Authority

- PAN: It is issued by the Income Tax Department of India.

- PRAN: It is issued by the Central Record-Keeping Agency (CRA) on behalf of PFRDA.

Structure

- PAN: It is a 10-digit alphanumeric code.

- PRAN: It is a 12-digit numeric number.

Usage

- PAN: It is required for tax filing, banking, investments, and high-value transactions.

- PRAN: Required for Pension contributions, withdrawals, and tracking retirement.

APY PRAN Number Search

Follow the simple step-by-step guide.

From the NPS website

- Search the NPS Lite website on Chrome

- Click to search without PRAN

- Fill in the details and click on APY ePRAN and master details view.

- Click on Submit

- Get your PRAN card containing the number and other details

Through Helpline

You can call on toll free number 1800-889-1030 for help

NPS Mobile App

- Download NPS by Protean App

- Login

- View your PRAN Number under the account details

From kfintech

- Go to kfintech

- Enter the required details

- Verify with OTP

- Get your PRAN number

Conclusion

The PRAN Number plays an important role in India’s pension ecosystem. It is a permanent identity for NPS and APY subscribers. It simplifies retirement planning by consolidating contributions, investments, withdrawals, and nominee details under one account. With lifetime validity, the PRAN helps in pension management. Whether you are a salaried employee, professional, or APY subscriber, knowing about your PRAN number is essential for tracking long-term savings and securing stability after retirement.

FAQs

Ques: What is PRAN Number?

Ans: It is a 12-digit permanent retirement account number used for managing contributions, investments, and withdrawals.

Ques: How to find PRAN number?

Ans: Go to the NPS Lite portal and click on search without PRAN to find your PRAN number.

Ques: What is the use of a PRAN Number?

Ans: It is a unique identifier used to identify and manage an individual’s pension account like tracking contributions, investments, withdrawals, and retirement benefits under NPS and APY.

Ques: What is the PRAN Number in the Aadhaar Card?

Ans: No, the PRAN number is not mentioned on the Aadhaar card.

Ques: What is the PRAN Number in the PAN Card?

Ans: A PAN card does not contain a PRAN number.