In today’s digital era, people depend on online payment for everyday transactions, particularly UPI Payments. This dependency on UPI transactions made fraudsters commit payment fraud. The victims are losing their precious money due to payment scams. That’s why people need to be careful during transactions through UPI. Don’t become a victim or get tricked by fake messages or payment screenshots. Always verify the UPI ID or the details before initiating a payment.

What Are Fake Payments UPI?

Fake Payments UPI refer to scams that fraudsters use to trick people into believing that they have received money or manipulate them into transferring money.

Scammers use fake payment links, screenshots, and misleading payment requests to steal money. The fake payment upi is a concern for UPI users. To avoid this kind of scam, people need to verify the transactions in UPI apps or bank accounts, try to ignore unsolicited links, and be careful of payment requests from unknown sources.

How Fake Payment UPI Scams Work?

Fake Payment UPI scams are used to convince people that a payment was made. These scams usually work in the following ways:

-

Fake Payment Links Scam: In this scam, fake payment links are used to request transactions. These links redirect victims to phishing sites, where users share sensitive UPI details, leading to unauthorized access.

-

Fake Payment Screenshots Scam: In this scam, fake UPI payment generators are used to create realistic-looking payment screenshots. These screenshots are displayed as proof of payment, even though no money was transferred.

-

Fake Payment Request Scam: In this scam, deceptive UPI requests are sent to people as payment receipts. However, accepting them deducts money from the recipient’s account.

-

Fake Payments Apps Scam: In this scam, fake payment apps that look similar to PhonePe and GPay are used. These apps show fake screenshots and sound alerts. This scam is typically used to deceive vendors and shopkeepers into believing that they have received payment.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to Verify Fake Payment UPI?

You can verify the fake UPI ID and protect yourself from payment fraud,

- Verify the UPI ID: Always check whether the UPI ID matches the official name of the business or individual before sending money.

- Check the Payment Request: Before making any transactions double-check the payment request including recipient and amount.

- Beware of Suspicious or Spam Links: Avoid clicking on the suspicious URLs or spam link to protect yourself from scam.

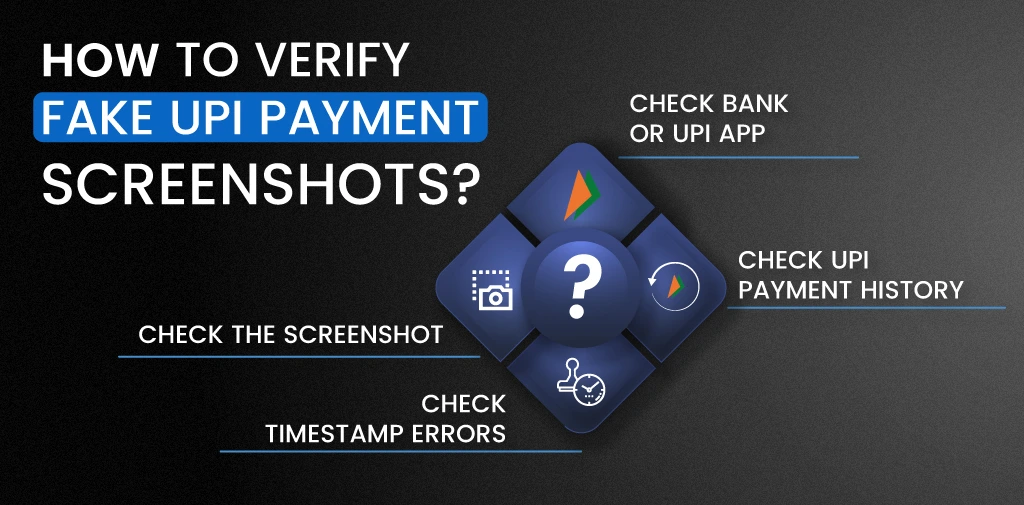

How to Verify Fake UPI Payment Screenshots?

Here is how someone can verify the fake UPI Payment screenshots,

-

Check On Bank or UPI App: People must check the transation details on bank app and UPI for payment confirmation instead of relying on screenshots. If the payment and screenshot data do not match, it means the screenshot is fake.

-

Carefully Check Every Detail of the Screenshot: Fake screenshots may have, wrong transaction ID, UPI Id, and formatting issues. It’s important for UPI users to examine screenshots to avoid falling victim to such fraud.

-

Check Timestamp Errors: Fake screenshots may have fake timestamps. That’s why it’s important to check the timestamp and transaction timings. If the timestamp does not match the original, it means it’s fake.

-

Check UPI Payment History: Check the transaction history in your UPI app, If the transaction or receiving amount is not listed in the app, then screenshot is fake.

Tips to Protect Against Fake Payment UPI Scams

Here are the tips UPI users can follow to avoid payment scams:

-

Instead of depending on the screenshot check the transactions in the UPI app.

-

Never click on the strange or unsolicited links.

-

Check transaction IDs in your UPI App before making payments.

-

Stay away from unknown payment requests.

-

Do not share your financial and personal data with anyone.

-

Never share your personal data on random websites.

-

Regularly check your transaction details.

-

Enable App notifications to receive payment confirmation instantly.

Steps to Take if You’ve Been Scammed

Here are a list of steps you should take if you will become a victim of a UPI payment scam:

- Report to your Bank: Immediately contact your bank and block the UPI Id.

- File Complaint: Use the UPI app to report scams in the “Help or Support” section.

- Change your UPI PIN: Change your UPI PIN to secure your UPI account and prevent further UPI payment scams.

- Register a Cybercrime Report: File a complaint to the Cybercrime portal or visit the local police station.

Fake UPI Payment Cases You Must Know.

Fake Payment Screenshot – Gujarat

Sanad Police arrested two men for buying an iPhone 16 using a fake UPI payment screenshot. They ordered an iPhone from Moje Motabhai Electronics showroom and shared a fake screenshot as proof of payment. However, no actual transaction was done. After finding, a complaint was filed with the police. On investigation, police arrested Akhtar Hussain and Mohmand Shaikh. Gujarat Samachar.

QR Code Scam – Madhya Pradesh

fraudsters secretly replaced and covered the QR codes of several shops with fake ones. Fake QR codes redirected customer payments to a fraudster to account instead of the shop owners. This came to notice when the shopkeepers were not receiving payment, and a customer noticed the name appear on scanning the QR Code. News18.

Conclusion

UPI has indeed made transactions easy, but it is prone to UPI payment fraud. Many people lose their money due to Fake UPI Payment Fraud. To avoid being a victim of payment fraud, people can follow the prevention tips such as checking their UPI ID, screenshot, timestamp, etc. Businesses can avoid these frauds by using Surepass UPI ID verification API.

FAQs

How to Identify Fake UPI Payment?

You can detect a fake UPI payment by checking the transaction ID, and timestamp, carefully checking screenshots, etc.

How do you Check if a payment screenshot is real or fake?

Check the transaction details in the UPI app whether they match with screenshot or not.

How Do I report a fake UPI transaction?

You can report fake UPI transaction complaints on the NPCI website or in the UPI App.