We often hear about financial crisis, bankruptcy, and loan defaults in news headlines. But do you know the “Undischarged Insolvent”? It is a legal status used for a person who is unable to pay the debt. This legal status affects a person’s financial and civil liberties.

Here, in this blog, you will learn about the undischarged insolvent, who is an undischarged insolvent is, and what legal restrictions they face.

What Is an Undischarged Insolvent?

An undischarged insolvent meaning a person or business declared bankrupt by a court but not yet released from debt obligations. In this case, various means are used to pay the finances to the creditor. This person faces restrictions in getting various high-profile job opportunities, an official post, or running a business.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Who is an Undischarged Insolvent?

An Undischarged Insolvent is an individual or entity that is declared insolvent or bankrupt by a court of competent jurisdiction. They have not yet completed the legal process required to eliminate or pay off the debts. The insolvent is prohibited from taking part in, or obtaining access to, numerous services, responsibilities as well and job roles. If the court declares the person insolvent and discharged, an official receiver or assignee will be appointed to handle the estate of the insolvent person. They are the ones who take charge of the estate of an insolvent and are responsible for selling off the assets and then distributing the proceeds to the creditors.

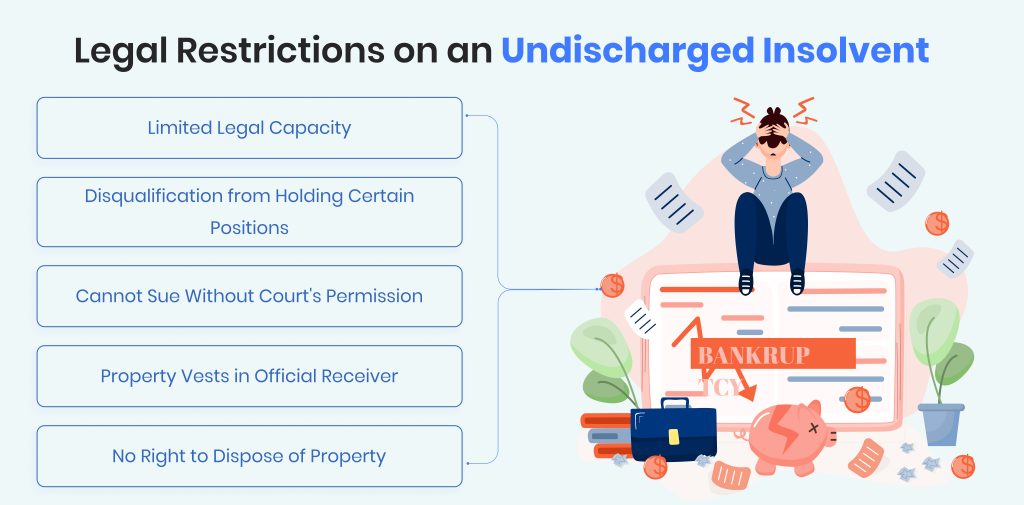

Legal Status of an Undischarged Insolvent

Being an undischarged insolvent is not merely a financial label—it carries a specific legal status. The court order of insolvency is public and becomes part of the legal record. As a result, the person:

- Cannot enter into contracts freely.

- Faces limits on owning or transferring property.

- May be barred from holding certain public offices.

- Must cooperate with the official receiver.

- Needs the court’s permission for major financial actions.

The legal system treats such individuals with caution because of their proven financial instability. While the purpose is not to punish but to protect creditors, the practical effect is a temporary loss of personal financial autonomy.

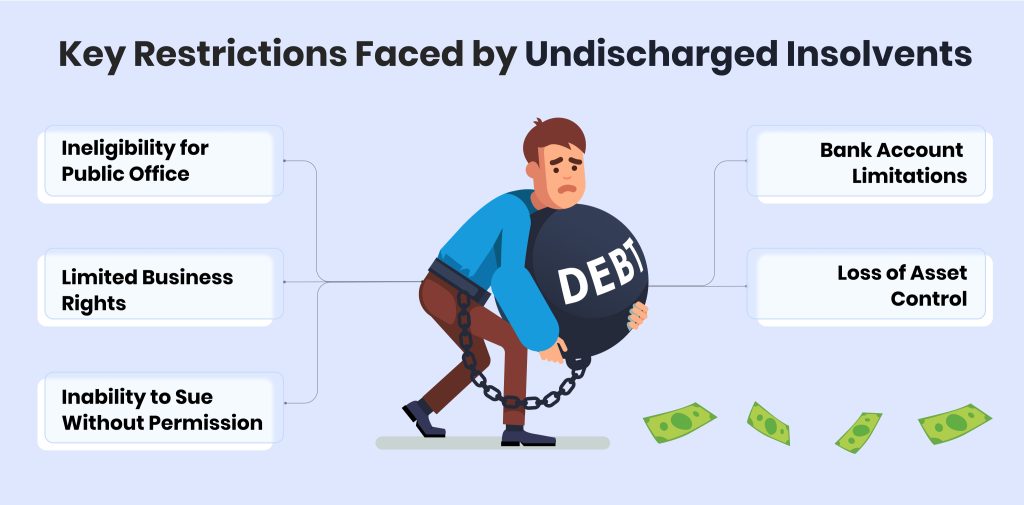

Key Restrictions Faced by Undischarged Insolvents

These are the main restrictions that insolvent companies face:

Ineligibility for Public Office: A discharged insolvent is not eligible to contest elections for office positions such as the Member of Parliament State Legislature, or Municipal Corporator. This law protects the public trust and makes sure that only those who are financially responsible have the power to govern public affairs.

Limited Business Rights: The law prohibits them from forming or running a business under the Companies Act, unless they have permission from a judge. This safeguards potential partners, investors, and lenders from financial risks.

Inability to Sue Without Permission: In the majority of cases, discharged insolvents require a court order to file a lawsuit or to defend themselves in legal matters. The reason for this is that their finances are taken care of by a registered receiver.

Bank Account Limitations: Financial institutions and banks often prohibit or even close accounts for non-paying insolvents. They might also reject a credit card or loan request due to their state of insolvency.

Loss of Asset Control: The property of the person is held by the official receiver or assignee with the power to liquidate assets in order to pay the debt. The person who is insolvent cannot trade or transfer their assets on their own.

How Can an Undischarged Insolvent Become Discharged?

Discharge is the final step in the insolvency process. It means the person is legally released from debts (except a few specific ones like government dues or fraud-related liabilities).

To obtain a discharge, the individual must:

- Fully cooperate with the insolvency court

- Honestly disclose all assets and liabilities

- Show good conduct during the process

- Ensure creditors receive a fair share from asset liquidation

The court then reviews the case and may:

- Grant Absolute Discharge (full release)

- Grant Conditional Discharge (with terms)

- Deny Discharge (if fraud is found or misconduct occurred)

Once discharged, the person regains full legal and financial rights and is no longer considered insolvent.

Real-Life Implications of Being an Undischarged Insolvent

The tag of undischarged insolvent is more than just a legal status; it affects people’s personal and professional lives. Many people find their employment opportunities limited, suffer reputational damage, and experience mental stress. Relationships can strain under the weight of financial instability, and it often becomes difficult to rebuild credit and trust.

But it’s also important to note that insolvency is not the end. With transparency, compliance, and time, one can become discharged and make a financial comeback. India’s legal framework is designed not just to penalize but also to rehabilitate.

Conclusion

Undischarged Insolvents are someone who’s declared insolvent by a justice, but hasn’t been exempted from this condition. It comes with a variety of legal limitations, ranging from the loss of the ability to run for an office in the public sector to restrictions on financial transactions.

Although insolvency is one of the most difficult chapters but it shouldn’t be the final chapter. By utilizing the best legal advice along with responsible decision-making and the right amount of time, people are able to overcome their insolvency and get back their financial independence.

FAQs

Ques: What does under insolvent mean?

Ans: It is a company or individual who is unable to pay the debt.

Ques: What does currently insolvent mean?

Ans: It refers to the company who don’t have enough finances to pay its debts.

Ques: Can an Undischarged Insolvent run a business?

Ans: No, they cannot start or manage a business under the Companies Act unless they get special permission from the court.

Ques: Who manages the assets of the Undischarged Solvent?

Ans: An official receiver is appointed by the court to manage and liquidate assets.

Ques: Is Insolvency a criminal offence in India?

Ans: It is a civil matter unless fraud is involved.