The GFF (Global Fintech Fest) is the largest fintech event held every year. It is organized by NPCI (National Payment Corporation), Fintech Convergence Council, and PCI (Payment Council of India).

GFF’s theme for 2025 was Empowering Financing to a Better Future Powered by AI. Global Fintech Fest was attended by all fintech innovators and leaders, including regulators, investors and technology experts. The three main pillars of the event were Augmented Intelligence (AI), Innovation and Inclusion.

The event attracted more than 100,000 participants this year from over 75+ countries. This included 7,500 companies, 800 speakers, and 400 exhibitors as well as 70 regulators.

Key Event Highlights From Global Fintech Fest 2025

Prime Minister Shri Narendra Modi inaugurated the Global Fintech Fest 2025 in Mumbai, Maharashtra, in the presence of UK PM H.E. Mr. Keir Starmer, Governor of the Reserve Bank of India Shri Sanjay Malhotra, and other dignitaries.

After giving a warm welcome to all attendees, Shri Modi expressed his gratitude to UK PM Keir Starmer for attending the event. He also highlighted the UK’s participation as the partner country this year. PM emphasized how India has made digital technology accessible to every region. He also referred to JAM Trinity – Jan Dhan, Aadhaar, and Mobile. He said that India handles half of the world’s real-time transactions, in which UPI alone completes over 20 billion transactions every month.

PM Modi explained that the DPI (Digital Public Infrastructure) works on a model where the government creates digital platforms for everyone, and the private sector builds new and innovative services.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

PM Modi said UPI, Aadhaar Payment System, Bharat BillPay, BharatQR, DigiLocker, DigiYatra, and GeM form the foundation of India’s digital economy.

He also described that MOSIP is helping over 25 countries create their own digital ID systems. He praised India’s fintech startup for creating globally relevant solutions, like interoperable QR codes and open commerce platforms. Now, India ranks among the top three most funded fintech startup ecosystems.

Our Prime Minister has introduced India’s AI Strategy based on Equitable Access, Population-scale Skilling, and Responsible Deployment.

Under the India-AI Mission, the government is developing high-performance computing capacity to make AI resources affordable and accessible to innovators and startups.

He announced that even though the UK AI Safety Summit began in the UK, the AI Impact Summit 2026 will be held in India. A new collaboration between the two nations. The UK’s financial expertise and research capabilities, combined with India’s scale and talent, will drive new opportunities via initiatives like the UK India Fintech Corridor. It connects startups, innovation hubs, and enables cooperation between the London exchange and GIFT city. Our Prime Minister invited Global Investors and Partners to collaborate with India.

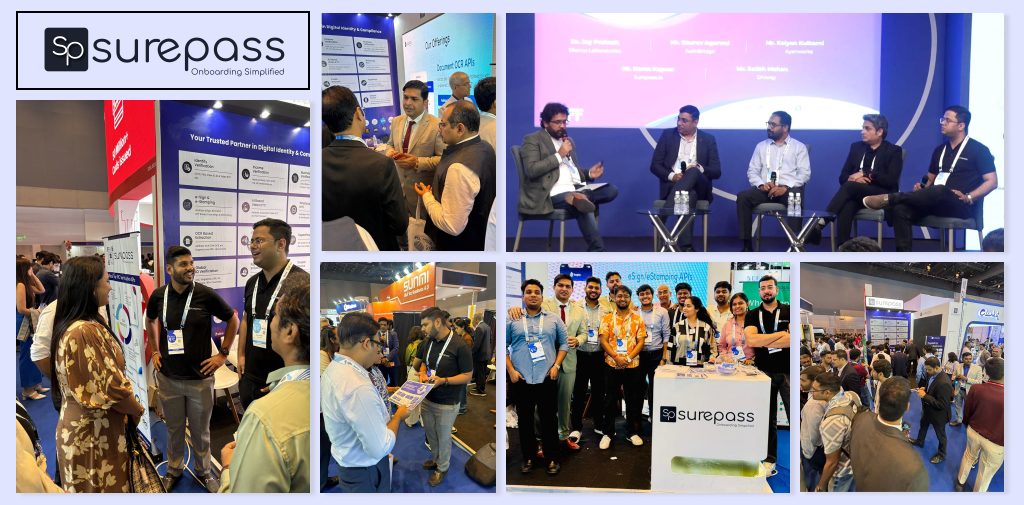

Surepass at GFF 2025

Thought Leadership

Our Director spoke at GFF on “Interoperable digital identity: The Missing Layer for a Trusted, Tokenized Economy and AI”. It shared insights on how digital identities changed security in the financial sector.

Engagement with Industry leaders

The GFF presents a valuable opportunity to engage with regulators, technology experts, and industry leaders. Surepass team has interacted with more than 2500 attendees, sharing their thoughts, requirements, and Ideas. We also met founders and CXOs to discuss digital payment, fraud prevention, and the role of automation. Businesses get a chance to exchange ideas on digital payments, fraud prevention, and automation in the financial sector.

Showcased Solutions our 300+ APIs, including:

- Real-time Identity Verification Solutions

- WhatsApp KYC

- Business Verification Solutions

- Income Verification APIs

- Credit Report Checks

Our advanced and customized solution makes onboarding efficient and error-free. This events helped Surepass to showcase the right solutions to the Banks and Fintechs.