A PAN (Permanent Account Number) Card is an important document issued by the Income Tax Department of India. It is a mandatory document for processes like filing income tax returns, opening bank accounts, and for high-value transactions. Checking PAN Card active status is essential for business and individuals for seamless operations and with financial regulations. Because An inactive PAN Card can cause issues like penalties and restrictions to use financial, and tax filing.

Things You Need to Verify PAN Status

- A Valid PAN.

- Mobile Number.

- A registered account on the e-filing portal along with a User ID and password.

How to Check PAN Card Active Status?

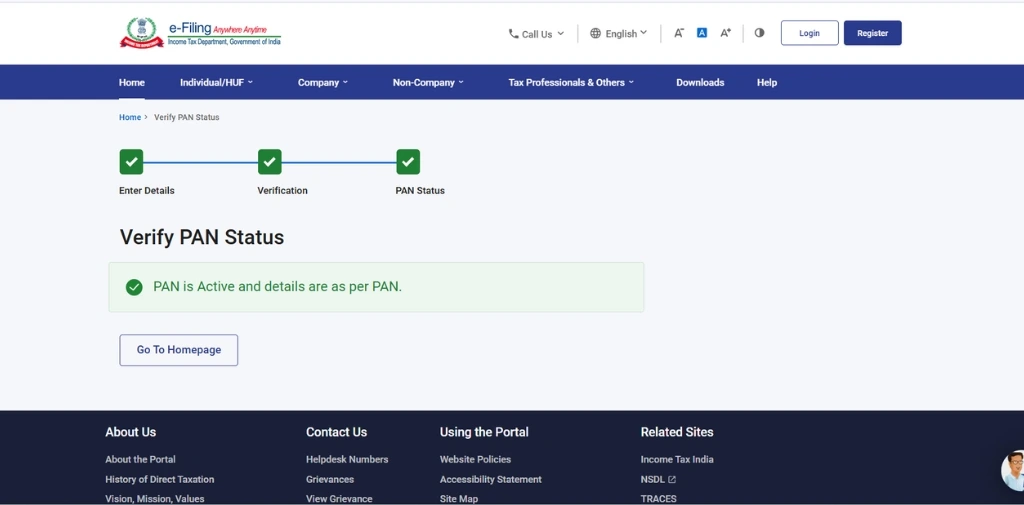

Follow these steps to verify the PAN Card status:

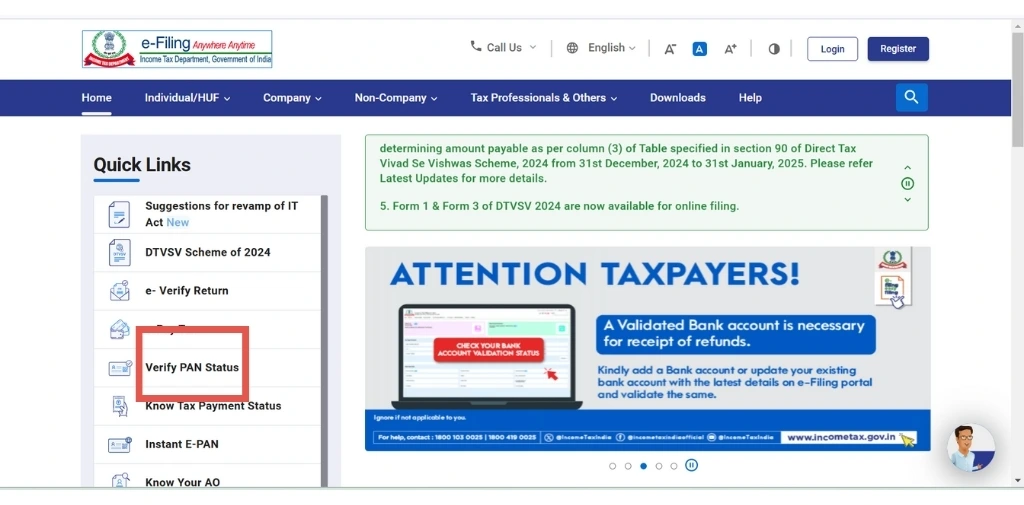

From e-filing Portal

- Visit the e-filling Portal

- Click on verify your PAN on the e-filing homepage.

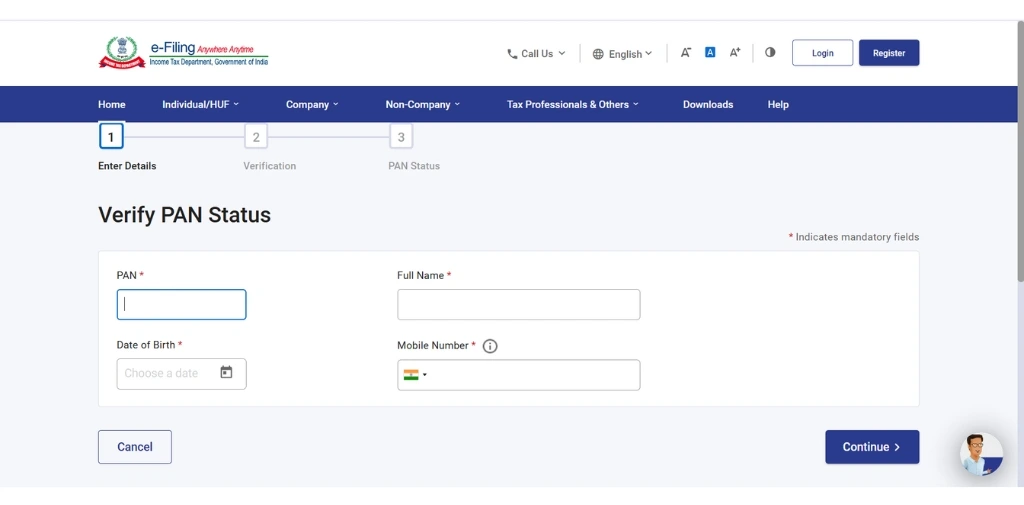

- Enter the PAN, Full Name, and Date of Birth, and click on continue.

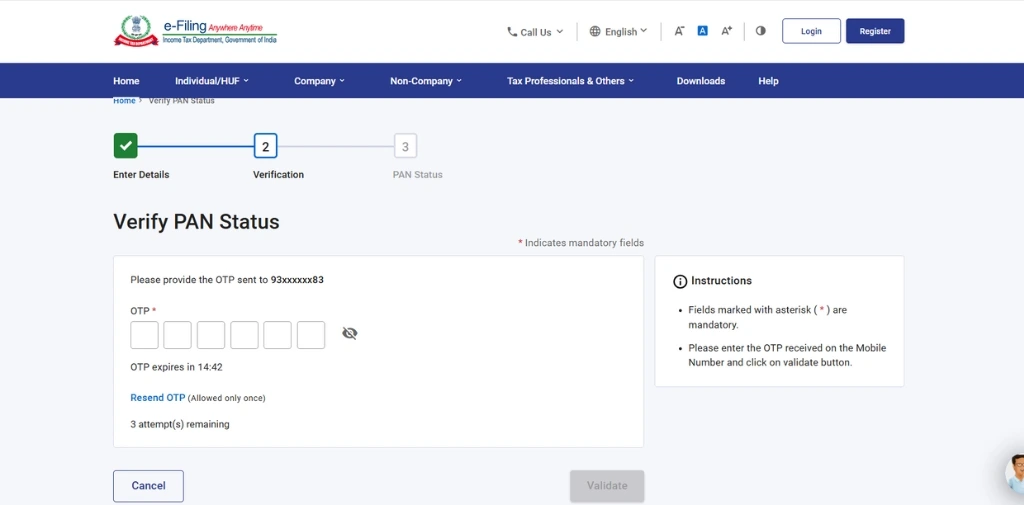

- Enter the 6-digit OTP and click on validate.

The PAN Card Active Status will be displayed on the screen.

To check the PAN Status of an External Agency follow these steps:

Visit the e-filing Portal

- Click on login.

- Login with a User ID and Password.

- Now click on the Services Tab.

- Click on view PAN Status.

- Enter the details (PAN Number, Full Name, DOB, DOI).

- Click on continue.

- Status will displayed on the Screen.

Through PAN Verification API

Follow these steps to use a PAN verification API to check the PAN Card active status.

- Upload the image of the PAN card in the API.

- The API will process the data.

- You will get the following status.

- Active

- Inactive

Importance of Regular PAN Card Active Status Check

A PAN Card is an essential document required for financial and tax-related transactions in India. Both individuals and businesses need to have an active PAN card to avoid complications in transactions.

Benefits of regular verification of PAN Card status

- An active PAN card status is necessary for banking, investment, or high-value transactions. It reduces the risk of interruption in services and disapproval in transactions.

- Regular monitoring of PAN cards helps in the detection of misuse of PAN such as unauthorized transactions or identity theft.

- A verified and active PAN is required to apply for government subsidies or schemes.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Consequences of an Inoperative PAN Card: Restriction and Penalties

You can face these issues, if you have an Inoperative PAN Card:

- Cannot open multiple types of bank accounts (except basic savings or time deposits).

- Can not apply for debit cards and credit cards.

- Limitations in cash transactions, you can not deposit more than 50,000 in a single day.

- Can not buy or sell properties of more than 10 lakhs.

- Can not apply or open a demat account.

If you have an inoperative PAN card then higher charges will be deducted for the following:

- Buying or selling a vehicle (except a two-wheeler)

- Buying or selling goods and services worth more than 2 lakh rupees in a single transaction

- Buying or selling property worth more than 10 lakh rupees by a stamp valuation authority.

Reasons For PAN Card Deactivation

According to the CBDT (Central Board of Direct Taxes), it is mandatory for all people to link their PAN Card with their Aadhaar Card. If anyone fails to link the following documents, their PAN will become inoperative. That’s why it is necessary for each person to link their PAN if they don’t want to face issues in tax filing.

If the person has more than one PAN card, then the Income Tax department will cancel the other ones. In the event, that a PAN card is granted on a false identity or existing individual, it will be removed.

How To Activate PAN Card?

These are the following ways you can opt to activate a PAN Card:

- Contact the income tax department: Contacting the tax department directly can help resolve the issues.

- Sent Letter To Jurisdictional Assessing Officer (AO): You can draft a letter that contains the request to activate your PAN card and send it to your jurisdictional Assessing officer in the income tax department.

Conclusion

An active PAN Card is important for accessing financial services. It is also necessary to avoid legal issues. As an individual PAN cardholder, you can check the PAN Card’s Active Status on the Income tax portal. Follow the above-mentioned steps to check the status on the portal. As a business, where you need to check bulk PAN Card Active Status, integrating API is better than verifying each PAN Card manually. It helps in the instant verification of multiple PANs simultaneously and saves effort.

FAQs

How Can I Check if my PAN card is active?

You can verify your PAN status on the e-filing portal.

Does PAN have an expiry date?

PAN Card don’t have an expiry, once approved.

How Can I keep my PAN card active?

Regularly check PAN Card status and follow the process of activation, if you find PAN in inoperative status.

How to Check the Validity of PAN Card?

You can check the validity of PAN Card

- E-filing Portal

- PAN verification API

How to Know that PAN is linked with Aadhaar or not?

You can check the link status between the PAN and Aadhaar on the Income Tax e-Filing website.

How to check the Validity of a PAN Card?

You can check the validity of your PAN Card on the e-filing portal or by using PAN Verification API.