Digital lending is growing tremendously in India and across the world. Modern borrower’s wants instant approvals, paperless processes, and smooth experiences. However, lenders are facing compliance issues and increasing credit risk. This scenario has created a tension between risk control and speed. For solving these issues, lenders don’t need several tools and APIs but a unified platform.

Problems with Today’s Underwriting

The banking, Financial services, and insurance sector often faces many challenges in credit underwriting, such as:

Fragmented Financial Data

Usually, a borrower’s financial information is scattered across multiple banks and apps. Collecting all this information makes it difficult to check the financial health of a borrower.

Unstructured Data

The BFSI sector receive fianncial information in the form of bank statement PDFs, images, or SMS alerts.

Ineffiecint

Manual checking and analysing each large volume of statements creates delays, increases turnaround time, and frustrates customers.

Fraud Prevention and Checking New Credit Borrowers

Finding suspicious transitions, forged documents, or unusual patterns is difficult and needs automated systems. Evaluating the financial health of MSMEs and gig workers is quite difficult. Because they don’t have a formal credit history or scattered financial information.

Limited Financial Visibility

Lenders and businesses struggle a lot to get a consolidated view of financial health, spending habits, and obligations across multiple accounts.

Delays in Loan Approvals

Today’s customers want faster loan approvals; however, the unorganized system makes it difficult to approve loans and results in customer drop-offs

Multiple Disconnected Solutions: Banks and lending institutions are using multiple tools for analysis, bureaus check, GST verification, and other checks. Their teams continuously switch between dashboards and reports.

Meet Finpass — The Operating System for Digital Lending

FinPass, powered by Surepass, is designed for lenders to operate at scale and solve all the underwriting issues. It combines underwriting, risk intelligence, and financial analysis into single platform.

It is designed to:

- Simplify complex financial analysis

- Standardize risk and compliance assessment

- Strengthens fraud prevention

- Helps in faster lending decisions

With Finpass, lenders can move from fragmented manual checks to a unified, insight-driven underwriting workflow, making credit decisions faster, safer, and more reliable.

FinPass Key Underwriting Capabilities

FinPass offers a smart and AI-based solution to streamline the financial analysis process, checking repayment capabilities.

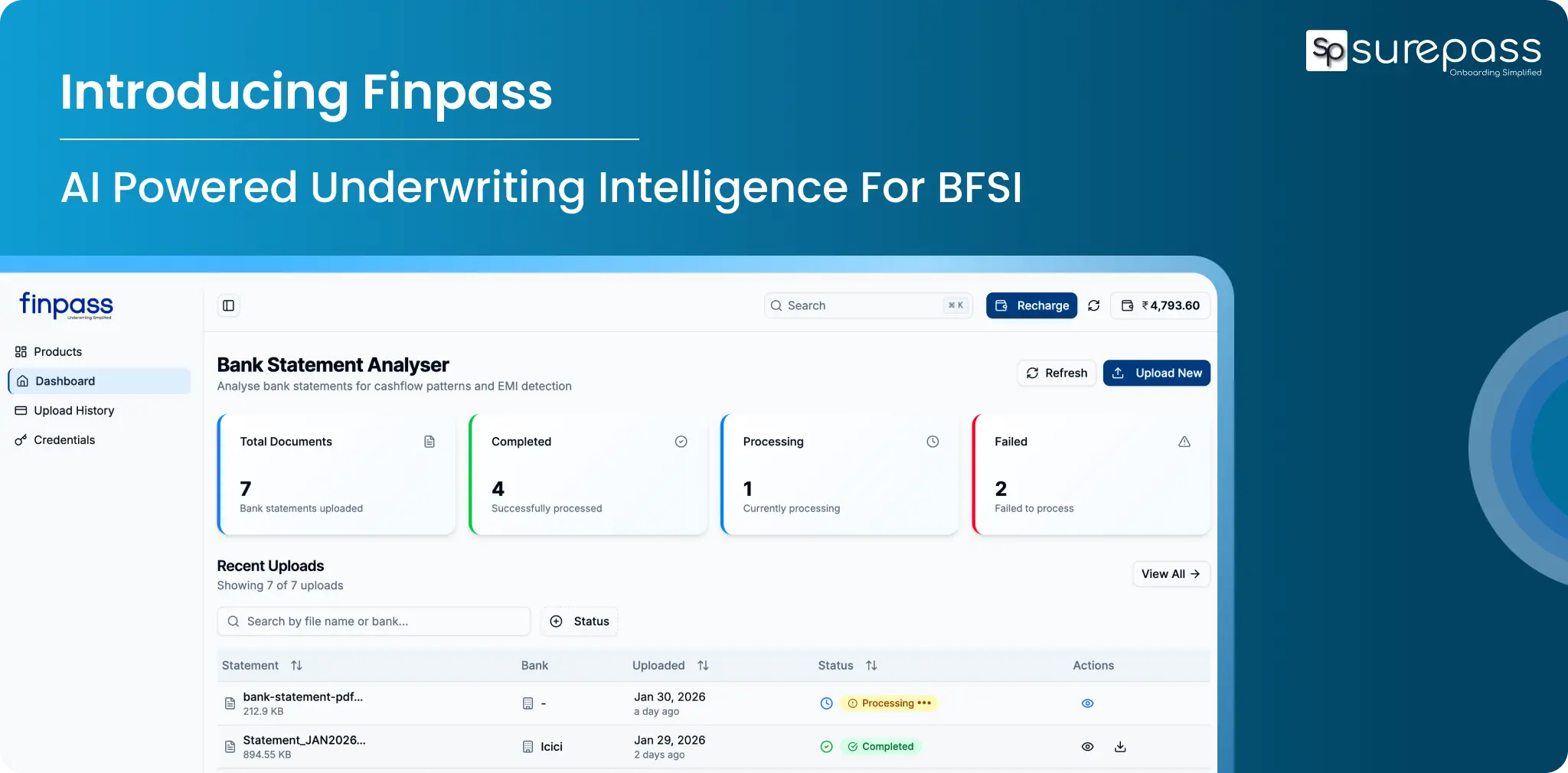

Bank Statement Analyser

Bank Statment Analyser AI-based solution that automatically analyzes bank statements and provides meaningful insights. It automatically extracts data from bank statements in formats like PDF, Excel, or CSV and transactions into income, expenses, and obligations.

It provided full financial information about a borrower, including spending patterns, cash flow trends, salary credits, EMI commitments, and suspicious transactions.

SMS Analyser

Finpass SMS Analyser helps businesses understand financial activity by analysing transactions related to SMS. It captures key details such as income credits, expenses, EMI payments, and account activity from bank and payment alerts. It organizes all the data into a structured format. It is best for evaluating the financial health of thin file customer with no formal credit history.

Account Aggregator

Account Aggregator connects more than 300 banks and financial institutions to give financial information with user consents. It uses RBI compliant account aggregation framework. It brings the borrower’s transaction history, balances, and financial record at one place. The unified platforms helps heldenrs in analyst make faster and more accurate decisions. It eliminates the need for manual document collection, enhances credit assessment, and keeps financial information secure.

Underwriting IQ

Underwriting IQ is a smart solution that helps lenders make smart credit decisions. It provides data from multiple bureaus, banking records, EPF, and ITR into one single system. The fraud checks, real-time risk scoring, and AI insights help in making the right lending decisions. It reduces manual efforts, reduces inaccuracies, and provides results within 30 seconds.

Automate your KYC Process & Reduce Fraud!

We have helped 3000+ companies in reducing Fraud by 95%

APIs Provide Data, An Operating System Delivers Decisions

Many banks and financial institutions rely on various APIs to get financial and Credit information of borrowers. But APIs only provide the raw data; however, understanding and analyzing this data to make informed decisions is the real problem. Lenders have to manually check each piece of information to understand the financial health. An intelligent OS like FinPass arranges data, adds intelligence, and provides decision workflows.

| Traditional Aproach | FinPass |

| Separate Tool | Unified Platform |

| Raw Reports | Decision ready insights |

| Manual Interpretation | Fully Automated |

| Case by Case review | Standardize Underwriting Logic |

Made for Every Lending Player: From Banks to Fintechs

FinPass is designed to streamline underwriting work for different lending businesses to work faster and smarter:

Banks and NBFCs: It helps banks and NBFCs make lending decisions faster with automated and accurate analysis of financial information.

Digital Lenders and Fintech: The risk score engine, along with quick insights of financial analysis, helps digital lenders approve loans quickly.

Insurance Companies: An insurance company can easily evaluate the financial health and repayment capability. This helps in quick approvals and reduce drop offs.

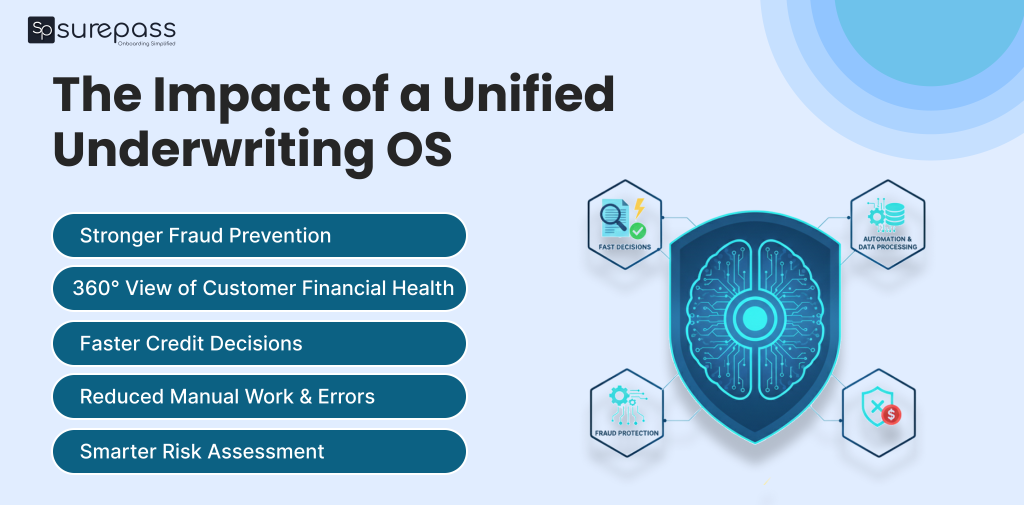

The Impact of a Unified Underwriting OS

Lenders using Finpass experience measurable benefits:

- Fraud Prevention

Thorough financial analysis helps identify suspicious activities like fake income, manipulated bank statements, mule accounts, and unusual transaction patterns.

- Comprehensive View of Financial Health

It combines bank statements, SMS data, account aggregators feeds, and bureau insights to give complete and accurate insights of cusomter financial in one place.

- Faster Credit Decision

Automated data extraction and AI-based analysis reduce manual review time. It helps businesses in take faster decisions.

- Reduced Manual Work and Errors

AI based analyser reads PDFs, SMS alerts, and bank statements. This eliminates the manual reviews and data entry needs and reduces the risk of errors.

- Better Risk Assessment

The risk scoring and transaction analysis helps lender check the repayment capability of borrowers, liabilities, and spending patterns.

Future of Underwriting

The lending sector is shifting from document-based assessment to real-time data-driven underwriting. Borrowers want instant approvals, and lenders need the right solutions to stay competitive without avoiding risk.

FinPass bridges this gap by providing a comprehensive, future-ready solution to fulfil next-generation lending needs.

Ready to Transform Your Underwriting Stack?

FinPass is not just an operating system, it is a powerful intelligent platform that offers everthing modern lender needs:

- Book a demo of FinPass today

- Talk to our experts

- Explore the FinPass solution