With the evolution of technology and AI, you can not differentiate between real and fake things with your human eyes. People can easily create clones or replicas of voice, face, and even emotions.

The whole internet is filled with examples of deepfakes – celebrity face swaps, and hyper-realistic impersonations in financial scams. Here in this blog, you will know how deepfakes have become a major threat to identity verification and fraud prevention.

What is Deepfake?

Deepfake refers to an artificial video, image, or audio recording. These images, videos, or audio are using AI to make them original. If you break the word deepfake, you will be able to understand its meaning. The term deep is used for deep learning, and fake is used for depicting fakeness or something fake.

Deepfakes are created using machine learning algorithms, Generative Adversarial Networks (GANs). In simple words, the advanced AI can generate fake content while another evaluates its realism, and through continuous feedback. The system learns to produce highly convincing imitations.

Now, the technologies have improved to the point that they can generate facial expressions, speech patterns, and even emotional tones with stunning accuracy.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Example of Deepfakes

These are threatening examples of Deepfakes, you must be aware of:

Indian WhatsApp/Video Deepfake Fraud in Kerala

A victim named Radhakrishnan from Kozhikode, Kerala, lost around Rs. 40,000 due to a deepfake. He received a video call from an unknown phone number. The person who appeared in the video call looks similar to his colleague from Andhra Pradesh. He asked him to transfer Rs. 40,000 due to an emergency. He transferred the money without any doubt. Then he again received a call and was asked to send Rs 35,000. This time it looks suspicious, so he contacted his colleague. He got to know that he had been scammed.

Corporate Video Call Fraud – HK $200 Million in Hong Kong

In Hong Kong, a finance employee from a multinational firm joined a video conference. In which the company’s CFO is involved. He transferred HK$200 million. However, in reality, the whole conference is a deepfake.

An Argentinian Woman lost 11.3 lakhs

In Argentina, a woman lost around ₹11 lakh. She received a deepfake video of famous actor George Clooney to receive her on Facebook. The fraudsters created a realistic-looking deepfake showing Clooney speaking, blinking, and smiling. She thought it was a genuine video call. The fake Clooney asked her to transfer money to the “Fans Club Card.” When she asked for money multiple times, she found it suspicious. She reported the whole case to the FBI. This case shows how deepfakes can also manipulate emotions. This example of Deepfake is threatening to people.

Volodymyr Zelensky Misinformation Deepfake

During the Ukrainian-Russian conflict, a deepfake video of Ukrainian President Volodymyr Zelensky viraled online. In which the president is urging soldiers to surrender to Russian Forces. The video was found to be fake; however, it has already spread on the internet.

Why Deepfakes Are a Growing Threat to Digital Identity?

Everything has two aspects, positive and negative. The same technology can also be used positively and negatively.

- Fake KYC Video and Selfies: Currently, fraudsters are using AI and machine learning faces during video KYC or selfie verification to bypass standard identity checks.

- Remote Work Risks: HR and Compliance teams face deepfakes impersonations during remote employee onboarding and video interviews. It leads to fake hiring and payroll fraud.

- Manipulated ID Proofs: AI tools can change or generate realistic fake documents (PAN, Aadhaar, and Passports).

- Synthetic Identities: Scammers combine sensitive personal data plus AI-generated visuals to create synthetic profiles that can open bank accounts or apply for loans.

- Detection challenges: Traditional biometric systems without liveness can’t differentiate between a real person and a manipulated video feed.

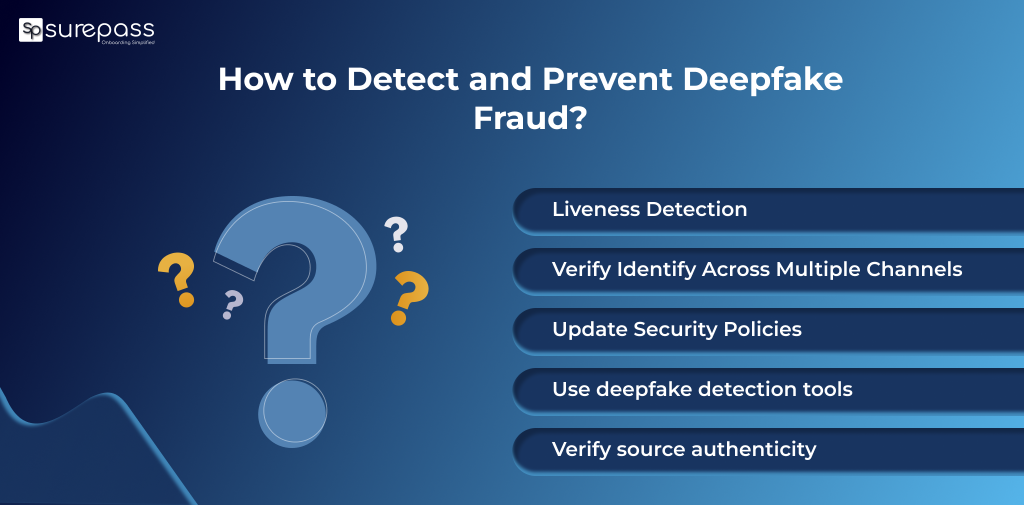

How to Detect and Prevent Deepfake Fraud?

As scammers are using new technology to cause fraud, it becomes essential for every organization to prevent fraud.

- Liveness Detection: The liveness detection technology thoroughly examines and analyzes the faceprint. It helps in detecting whether the person on video is real or a deepfake.

- Verify Identify Across Multiple Channels: You should integrate multi-factor authentication methods such as face match, document verification, liveness check, and behavioural biometrics for accurate identity verification.

- Update Security Policies: As deepfakes and AI technology are rapidly growing and changing, it has become essential for businesses to update their security and privacy policies. Any negligence can lead to heavy penalties.

Conclusion

The evolution of technology and AI has brought several advantages to the digital ecosystem. However, fraudsters are using advanced technology for illicit purposes, such as deepfakes. This technology is used for stealing money, creating deepfakes of celebrities and politically exposed persons to spread fake news, such as fake videos of Zelensky. You can give a glance at a shared example of a deepfake and how deepfakes are threatening.

FAQs

Ques: Can Humans Detect Deepfakes?

Ans: Yes, humans can detect deepfakes. However, with improving technology, it is a challenge to detect deepfakes.

Ques: What are the red flags of Deepfakes?

Ans: These are common red flags of deepfakes:

- Unnatural blinking and eye movement

- Audio Imperfections

- Facial Anomalies

- Payment Fraud

- IP Theft

Ques: How to differentiate between a deepfake and a real?

Ans: You can detect deepfakes by checking unnatural facial movements, voice modulation, and mismatched lip sync.

Ques: How can organizations protect themselves from deepfake fraud?

Ans: Organizations can protect themselves from deepfakes by integrating multi-factor authentication.