Today’s businesses face challenges in large-scale transactions like high costs, errors, and inefficiencies. Bulk Payment with single instruction multiple transactions features comes as an effective solution that reduces the cost and enhances efficiency. In this blog, you will learn everything about Bulk Payments, its features, benefits, processes, etc.

What is Bulk Payment?

It is a process of paying multiple beneficiaries simultaneously with a single instruction. It eliminates the processing of each payment individually, now businesses and organizations can make all payments into one request. It helps save time and manual effort with accuracy.

Features of Bulk Payments

- Single Instruction Multiple Transactions: The Bulk Pay processes thousands of payments simultaneously on a single instruction.

- Automation: Payments are processed automatically which reduces the need for manual inputs.

- Scalability: It can handle hundreds or thousands of transactions efficiently.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

What’s the Difference Between a Bulk List and Bulk Payment?

Both Bulk lists and payments are interconnected but play different roles. Here is a brief of the bulk list and Bulk Payment.

A bulk list is a file with payment details of multiple recipients. It is used as input during Bulk Payment processing. It usually contains information like beneficiary names, bank account details, payment amounts, etc.

Bulk Payment is the transfer of payments to multiple beneficiaries at once, based on the bulk list data. It is used for bulk transactions in a single action instead of time-consuming individual transactions.

Why are Bulk Payments Important for Businesses?

Bulk Payments are important to be a part of business for the following reasons:

- Save Time: This solution allows businesses to process multiple transactions simultaneously and saves time.

- Reduce Cost: Bulk Payment processing reduces transaction costs, if we compare it with the individual payment to each recipient.

- Improve Efficiency: Bulk Payout minimizes repetitive tasks, and simplifies payroll, vendor payment, and other financial transactions.

- Error Reduction: This system reduces human errors by automating transfers.

- Improve Cash Flow Management: Bulk payout gives access to the business to organize and schedule the cash flow.

- Real-Time Tracking: Businesses using Bulk Payment services have access to monitor payment status, disbursement, and accountability.

- Improve Relationships: On-time payment improves the relationship with vendors, partners, and employees.

How Bulk Payments Work – The Process

Here is how Bulk Payment works:

- Data Preparation

Collect details of all recipients and create a bulk list in formats like Excel and CSV. The details include the recipient’s name, bank account number, IFSC Code, payment amount, etc.

- Upload the Bulk List

Log in to the Bulk Payment platform system, and upload the bulk list you have prepared. The system will verify the details.

- Payment Processing

After the verification of details, the system will initiate the payment processing. The payment will be disbursed from the wallet to the recipient’s accounts. Here are the supported payment methods

NEFT/RTGS/IMPS for domestic transfer

SWIFT for international transfer

- Confirmation and Notifications

After the payment is successfully processed, the system generates the payment confirmation. Usually, automated notifications (emails/SMS) are sent to the business and recipients.

- Reports

All payment details which include transactions and timestamps are recorded. Businesses can download these reports for auditing, reconciliation, or analysis.

Bulk Payment Types

- Standard Domestic Bulk Payment

It refers to transfers within the same country to multiple bank accounts. It usually involves salary disbursements, vendor payments, bonuses, and reimbursements.

- Common Methods

NEFT (National Electronic Funds Transfer)

RTGS (Real Time Gross Settlement)

IMPS (Immediate Payment Transfer)

- Bulk Inter-Account Transfer

It refers to the transfer of funds between multiple accounts within the same bank or organization.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Methods of Bulk Payments in India

Here is a list of available Bulk Payments in India:

Bank Transfer for Bulk Payments

Many banks offer corporate bulk transfer services. It allows businesses to make multiple payments simultaneously.

Corporate Bulk Bank Transfer Challenges:

- Limited Payment Modes: Usually, corporate banking portals do not support UPI and IMPS for bulk transfers.

- Compatibility issue with browser: Some portals are incompatible with modern browsers like Chrome or systems like MacOS.

- Time Restriction: Bank portals operate only during the bank’s working hours, which limits 24X7 access to payment services.

- Cooling Period: Adding multiple beneficiaries requires a cooling period before initiating transfers.

- Failed Transfer: Failed fund transfers are common, and the reconciliation process is time-consuming.

Payouts

Solutions like Surepass Bulk payouts provide user-friendly alternatives to bank transfers.

Benefits of using Payout platforms for Bulk Payment processing.

- Supports Multiple Payment Modes: Payouts support RTGS, NEFT, IMPS, UPI, wallets, and bank transfers.

- 24X7: Allows you to make payments any time of the day.

- Automated Process: Upload bulk list via Excel or API.

- User Friendly: It provides an easy-to-use interface that anyone can use without technical knowledge.

Bulk Payment Through UPI

Businesses can process Bulk Payments directly to virtual UPI IDs. This simplifies fund transfers.

Benefits of UPI Bulk Payments

- Payments are sent to multiple virtual UPI IDs simultaneously.

- It gives easy reconciliation since every UPI ID is linked to a specific beneficiary account.

How to Choose the Right Bulk Payment Solution?

You must look at the following things before buying a plan:

- It should support multiple payment solutions like NEFT, RTGS, IMPS, UPI, and wallets.

- Opt for a service that provides 24/7 support.

- The dashboard should be user-friendly and support Excel, CSV, etc.

- The system should easily integrate with platforms like ERP, payroll, and accounting systems.

- Choose the service that offers affordable pricing.

- Track payments and generate reports for easy reconciliation.

- Choose the solution that supports refunds and payout links.

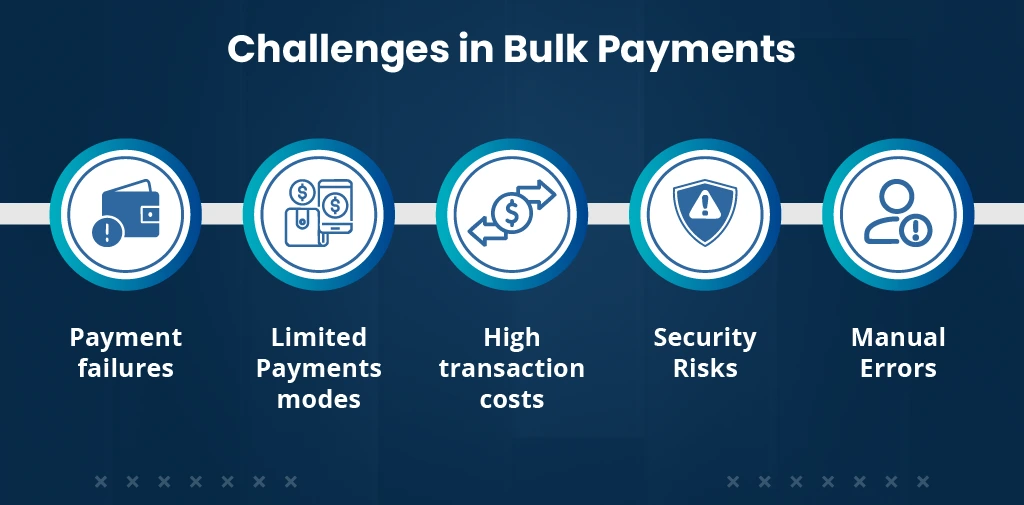

Common Challenges in Bulk Payments and How to Overcome Them

Here are the challenges that commonly occur in Bulk Payments:

- Payment failures: Incorrect details lead to failed transactions that’s why use the bank account verification before initiating payment.

- Delayed Processing: Bank Portals operate only during working hours. It is better to use a platform that provides 24/7 real-time payment options like IMPS and UPI.

- Limited Payments modes: Some portals support only NEFT or RTGS. Choose the one that offers multiple payment modes like Wallet, UPI, IMPS, NEFT, and RTGS.

- Cooling periods: Some platforms require a cooling period to add beneficiaries. It is recommended to use a platform that provides instant beneficiary addition.

- High transaction costs: Bulk Payment services offer different plans and pricing. Compare features with pricing and choose wisely keeping features and pricing in mind.

- Security Risks: Payment information comes under the sensitive data category and is prone to data breaches. Use a reputed platform that has an advanced security system.

- Reconciliation Issues: Manual reconciliation is time-consuming. Use platforms with automated reconciliation and clear reporting tools.

- Manual Errors: Errors in data entry cause incorrect payments. Use API-based Bulk Payment solutions that work with minimum errors.

Conclusion

Bulk Payment solutions simplify large-scale transactions, save time, reduce errors, and enhance efficiency. It removes common issues of traditional banking limitations with 24/7 access, multiple payment modes, real-time tracking, and automation. Businesses should use Bulk Payment services for large-scale transactions.

FAQs

What is a Bulk Transaction?

It is a process of transferring payment to multiple recipients simultaneously through a single click or instruction.

How to make Bulk Payments?

Bulk Payment can be made by uploading a payment file (File/CSV) and instructing for transactions.

What is bulk transfer?

It is a process of transferring funds to multiple accounts simultaneously with a single transaction.