Whether it’s opening a bank account or applying for a SIM Card, verifying Aadhaar is essential. It reduces the risk of document fraud, identity theft, and associated legal issues. Traditional and manual verification is time-consuming and prone to errors. On the other hand, online verification is quick and accurate. However, for verifying Aadhaar online, you need to become an AUA KUA. Here, in this blog, you will learn about the AUA and KUA.

What is AUA? (AUA Full Form and Meaning)

AUA full form is Authentication User Agency, a government, public, or private entity. These entities can use the Aadhaar authentication system to verify identities. In simple terms, AUA is an entity authorized to perform Aadhaar-based authentication for service delivery. It connects with CIDR for accurate verification.

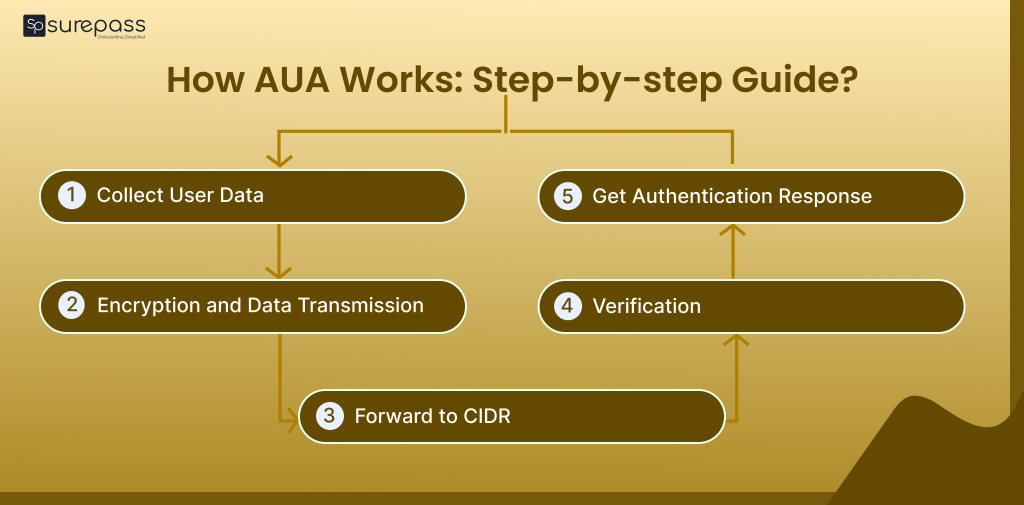

How AUA Works: Step-by-step Guide?

Here is how AUA works:

- Collect User Data: The AUA first collects the resident’s Aadhaar Number along with the required authentication input, such as OTP, biometric data, or demographic information.

- Encryption and Data Transmission: The collected sensitive data is encrypted and sent through the AUA’s infrastructure to the UIDAI system.

- Forward to CIDR: The verification request is forwarded to ASA or to the CIDR (Central Identities Data Repository).

- Verification: The CIDR verifies the input information with the Aadhaar records.

- Get Authentication Response: After verification, the CIDR sends a confirmation to Yes (Authentication Successful) or No (Authentication Failed) response to the AUA.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

What is KUA? (KUA Full Form and Meaning)

KUA full form is KYC User Agency. It is an entity that uses Aadhaar e-KYC for identity verification services. It sends requests through a KYC Services Agency (KSA) to the UIDAI server to fetch a resident’s verified details, such as name, address, and photo, after OTP verification.

KUA Registration with UIDAI

Before initiating e-KYC services, an entity:

Needs to obtain authorization from the UIDAI to act as KUA. You need to register with the KYC Services Agency. This agency is like an intermediary between the KUA and CIDR.

How does KUA work?

Here is the step-by-step guide on how KUA works:

- KUA Registration: Organizations need to become a KYC User Agency. The need to follow the UIDAI security guidelines and connect with the KSA (KYC Service Agency).

- Customer Consent: Customer Aadhaar number and consent are obtained for sharing e-KYC data.

- Authentication Initiation: The KUA collects the OTP or biometric data from the customer. Then it sends the e-KYC request to the UIDAI.

- Verification: UIDAI verifies the Aadhaar details and sends demographic information and a photo on successful authentication.

- Get Verification Response: After successful verification, the KUA receives the data securely from UIDAI for verification.

AUA KUA: Difference

Both AUA and KUA help in Aadhaar verification; However, their roles are different:

- Full Form: AUA full form is Authentication User Agency, and KUA full form is eKYC User Agency.

- Functions: AUAs’ main role is to perform Aadhaar verification. It only verified the identities without accessing detailed demographic data. KUAs on the other hand, perform Aadhaar e-KYC. They can access limited demographic information for verification purposes.

- Data Access: AUAs can only receive the authentication responses. It confirms the privacy of the user’s data. KUAs have access to demographic data needed for KYC processes, like name, address, and DOB.

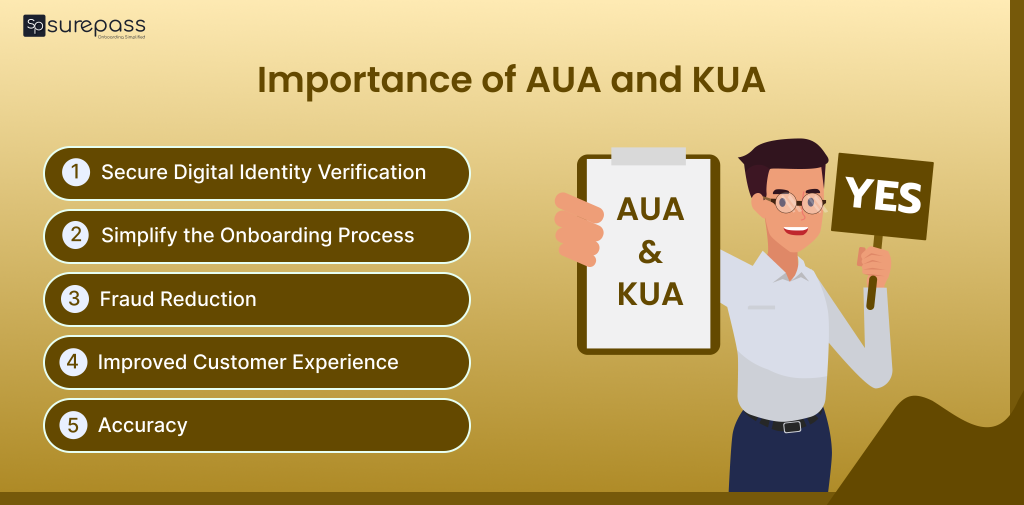

Importance of AUA and KUA

These are reasons why AUA and KUA are important:

- Secure Digital Identity Verification:

AUAs and KUAs confirm that the Aadhaar-based verification and e-KYC process is secure and reliable.

- Simplify the Onboarding Process

AUA KUA helps businesses and government agencies in quick verification without physical document verification.

- Fraud Reduction

The online verification directly from the UIDAI database confirms accuracy and prevents identity theft.

- Improved Customer Experience: Users can easily complete verification instantly, which saves time and effort.

- Accuracy: The CIDR contains up-to-date information that ensures accuracy in the verification process.

Key Challenges for AUAs and KUAs

These are the challenges an AUA and KUAs face:

- Regulatory Compliance and Audits

AUAs and KUAs should follow the UIDAI guidelines. This includes data protection and secure handling of sensitive data, along with regular audits. Non-compliance can lead to penalties, suspensions, or legal actions.

- High Costs

The entity needs to maintain the infrastructure for Aadhaar verification and e-KYC, it requires a high investment.

- Data Security and Fraud Prevention

The verification agencies should implement secure encryption, access control, and fraud detection mechanisms to protect against data breaches and unauthorized access.

Become an official Sub-AUA and Sub-KUA with Surepass

As discussed earlier, becoming an AUA or KUA requires high cost, technical expertise, or more. Becoming a Sub-AUA and KUA is an easy alternative for the entities that want to conduct Aadhaar verification without any legal risk. You can easily become Sub-AUA and Sub-KUA within 30 days with the help of Surepass.

Conclusion

For secure and successful Aadhaar verification, you need to be an AUA and a KUA. Here, AUA’s full form is Authentication User Agency, and KUA’s full form is eKYC User Agency. Both of these entities help in Aadhaar verification. The key difference between them is that AUA only confirms authenticity, whereas KUA can provide demographic data for verification. Being AUA and KUA brings several advantages, like enhancing onboarding, verification accuracy, and risk of fraud.

FAQs

Ques: What is the full form of AUA in Aadhar?

Ans: AUA full form is Authentication User Agency.

Ques: What is the full form of KUA in Aadhaar?

Ans: KUA full form is eKYC User Agency.

Ques: What is an AUA KUA Audit?

Ans: It is a mandatory process that ensures that AUA and KUA are following security and privacy guidelines.

Ques: What is the AUA Meaning?

Ans: AUA refers to the entity that uses Aadhaar Authentication services to verify identities.

Ques: Who can apply for AUA and KUA?

Ans: Organizations like banks, telecom companies, government agencies, and service providers can apply for AUA and KUA authorization.