During the KYC process, people’s applications are often rejected due to misspellings. A discrepancy can lead to rejections and drop-offs. To resolve this issue, an AI-based name-matching solution is required. Surepass offers an intelligent solution that accurately identifies the closest match, minimizes errors, and streamlines the KYC process. Here in this blog, you will learn about the Surepass AI-powered Name Match Solution and how it helps.

Common Name Mismatches Issues in KYC

These are the most common issues that occur in KYC name matching:

- A minor spelling mistake of even one letter can create name variations and result in KYC verification failures.

- Common mismatch that usually occurs are missing middle names, extra spaces, or different spellings.

- Mismatches occur due to typos, manual data entry errors, and OCR inaccuracies.

- Regional name variations and different formats in documents result in complexity.

- Name changes after marriages or legal updates create inconsistencies.

- Verification systems may reject genuine users due to rigid matching logic.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

What is AI Name Match Solution?

AI Name Match Solution is an advanced technology. It uses artificial intelligence and machine learning to intelligently compare and match names. These solutions are capable enough to find good matches. It understands variations, spelling errors, typos, regional differences, or formatting issues.

For example:

- “Mohd. Salman” and “Mohammed Salman.”

- “Raj Sharm” and “Raj Kumar Sharma.”

How Surepass AI-Powered Name Match Works?

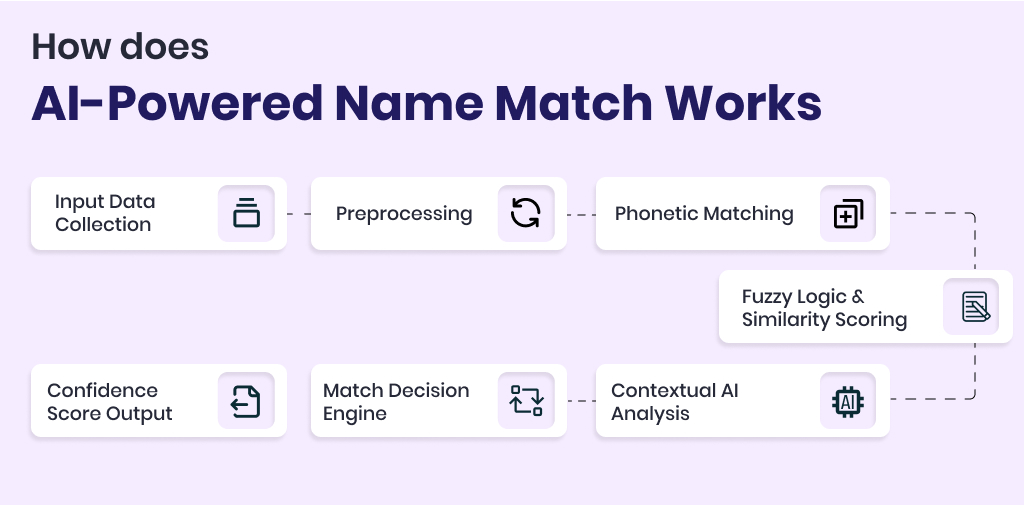

Surepass AI-Powered Name Match Solution is made to identify and match names across documents. It is capable of finding words that are misspelled, abbreviated, or formatted.

Intelligent Name Comparison

- Phonetic Algorithms: These algorithms evaluate the pronunciation of names to find the matches. It found similar names with the same sounds.

- Fuzzy Logic: Fuzzy Logic helps in understanding the degree of name variations to handle minor spelling errors, typos, and variations in name formats.

- Linguistic Models: These models understand the structure and components of names, accommodating regional and cultural naming conventions.

These algorithms help in finding similar name matches and provide confidence scores.

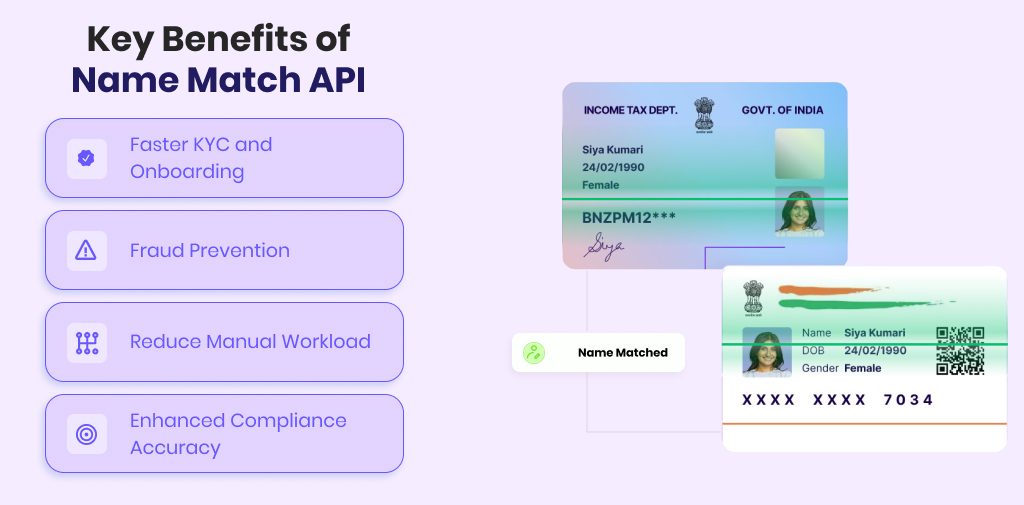

Key Benefits of Name Match API

- Faster KYC and Onboarding: Our AI-powered Name Match API reduces the verification time with quick retrieval of similar names with confidence scores. It helps in quick approvals and efficient customer onboarding.

- Reduce Manual Workload: The API adds automated name matching, which removes the need for manual input. It saves time and reduces errors.

- Enhanced Compliance Accuracy: Verifying the name accurately is essential for compliance. Surepass AI-powered Name Match API ensures that identity matches are precise, helping your business stay compliant with KYC norms and avoid penalties.

- Fraud Prevention: Surepass AI detects and flags mismatches or suspicious name alterations that may indicate identity fraud. Its proactive approach helps protect your business from fraud risks.

Industry Use Cases

- Fintech and Digital Lenders: The AI Name Match helps in the quick and error-free identity verification. Name Match API detects mismatches across documentation like PAN, Aadhaar, and reduces the delays and fraud.

- Insurance Providers: AI Name Matching API ensures that the name of the person matches across all submitted documents. It will speed up the policy issuance and minimize claim disputes.

- Telecom Companies: It can be used for customer verification during SIM activation. It helps prevent identity misuse and fake KYC submissions.

Why choose Surepass for AI Name Matching?

Here is the reason why you should choose Surepass for name matching solutions:

- High Accuracy: Surepass AI-Powered Name Match API is designed and built on advanced algorithms. It is trained to detect and intelligently match names that vary because of typos, extra spaces, abbreviations, and regional spellings.

- Supports Multi-Document Matching: AI Name Match works across PAN, Aadhaar, bank records, and other ID documents. It makes the name matching throughout the verification journey.

- Language and Region Agnostic: Our Name Match API is able to handle local name formats, phonetic similarities, and multilingual entries effectively.

- Real-Time Results with Confidence Score: It provides name match results, including exact match and partial match with confidence scores to automate approvals.

Conclusion

Errors in the name during the customer onboarding and KYC process are common. It leads to customer drop-offs, delays in verification, and fraud risk. To overcome these issues, an organization can use a name-matching solution. Surepass AI-powered name matching is the best solution. It uses advanced algorithms like Phonetic Algorithms, Fuzzy Logic, and Linguistic Models for finding the best matches with a confidence score. Bank, Financial Institution, Fintech Platforms, and Telecom companies can use this Name Matching solution to reduce name-related errors in verification.

FAQs

Can AI find Name Match?

Yes, you can find Name Matches with the Surepass AI-powered Name Match Solution.

How Accurate is AI-Powered Name Match API?

AI Name Match API delivers 99% accurate results.

Can it handle regional name variations (e.g., South Indian or North Indian Names)?

Yes, the API understands regional name variations.

What is the difference between an exact match and a Partial Match?

Exact Match: 100% Identical Names (e.g., Rajesh Kumar = Rajesh Kumar)

Partial Match: Similar name with a confidence score (Rajesh Kumar = Rajesh K., scores 85%)