Introduction

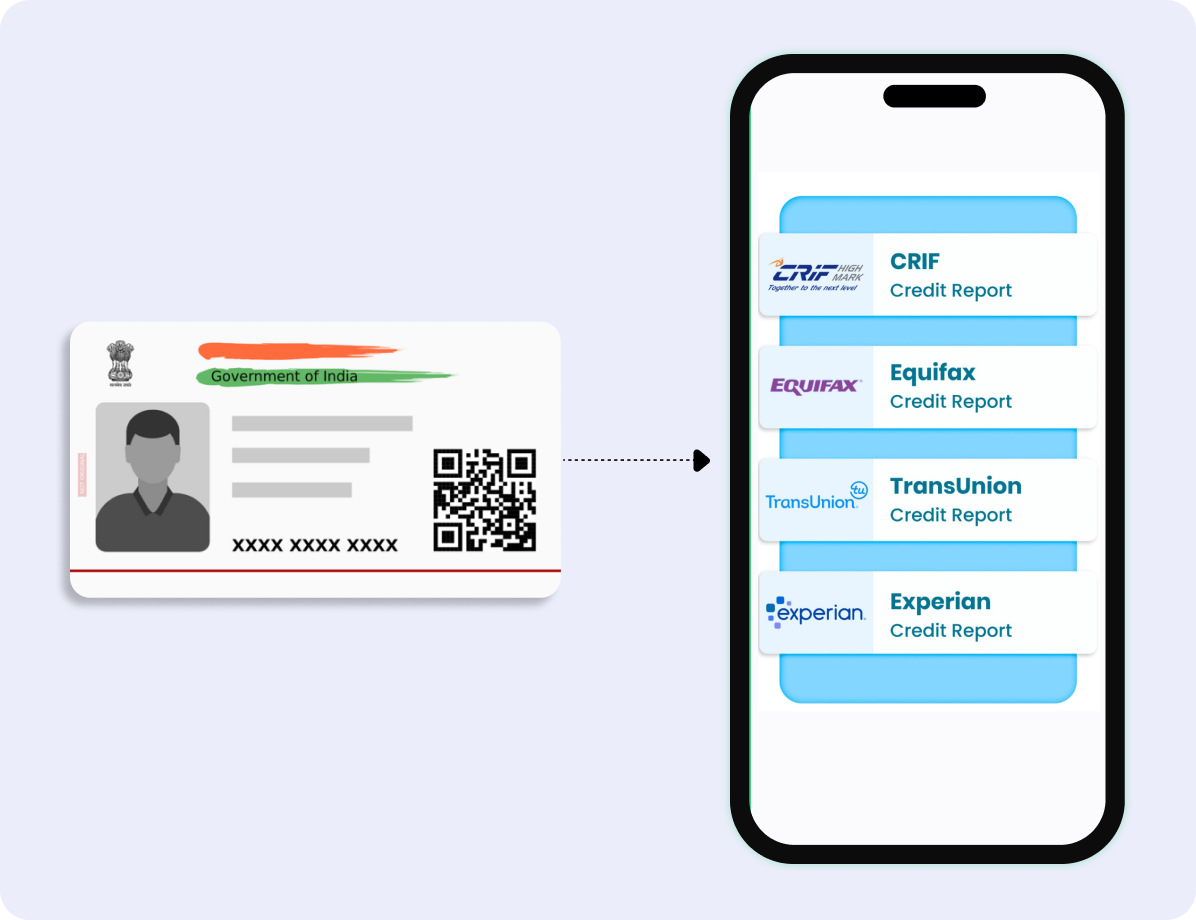

Aadhaar to Credit Report API streamlines the credit check workflows of organizations. Automates the filing of required information. This eliminates manual processes that take a lot of time. The process can be handled efficiently and accurately, reducing errors and saving time. The solution simplifies the credit approval process and onboarding of new customers.

Use Cases

- Banks and Financial Institutions: Banks and financial institutions can use this API to simplify the credit verification and loan approval process.

- Creditworthiness Checks: Fintech companies can use it to check creditworthiness quickly before providing loan approvals.

- Rental and Employment Screening: Property owners and employers can use this solution to evaluate financial stability before renting or hiring candidates.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent fraud by identifying newly issued Aadhaar numbers and flagging suspicious identities during verification or onboarding.

Accurate and Reliable

Our system checks the information from the department. Therefore, the results are always correct and legitimate.

Blog

What Is Aadhaar Verification API, Why Use It?

What is Aadhaar to Credit Report API?

Can it handle bulk operations?

Who can use Aadhaar to Credit Report Solutions?

Is the Aadhaar to Credit Report Process Secure?

Can I integrate the API into the existing business system?

What are the benefits of using the Aadhaar to Credit Report API?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More