Introduction

Linking Aadhaar with PAN is an essential process in India. This linkage plays a crucial role in tax filing, account opening, and digital onboarding. Aadhaar–PAN Link Status confirms whether this linkage has been completed.

The verification is particularly useful in sectors like banking, finance, fintech, insurance, and public services.

Use Cases

- Banks & NBFCs: It helps verify customers’ identities before processing loans or account opening.

- Fintech Platforms: Fintech Platforms can use this API for the KYC during the user sign-up process.

- Insurance Providers: Insurance providers can use this API to verify customer identity before issuing policies or setting claims.

- Employers & HR: Employers and the HR team can use this API for quick verification of Aadhaar and PAN during document verification.

Benefits of Verifying with our API

Plug and Play

The PAN and Aadhaar Link Status API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

The process will save any institution that has been and can be a victim of fake cardholders.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legit.

Blog

What Is Aadhaar Verification API, Why Use It?

What is Aadhaar–PAN Link Status Verification?

Why is Aadhaar–PAN linkage important?

Can I integrate this API into the existing business system?

What happens if Aadhaar is not linked with PAN?

Can this check help detect identity fraud?

Does it have a batch processing verification feature?

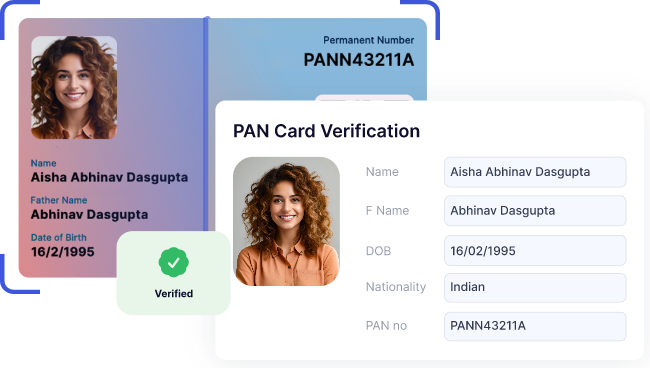

Pan Verification API

PAN verification API is imperative to have, From Banks, NBFC’s to other financial institutions. A Permanent Account Number also known as PAN is a must have document for any taxpayer.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More