Introduction

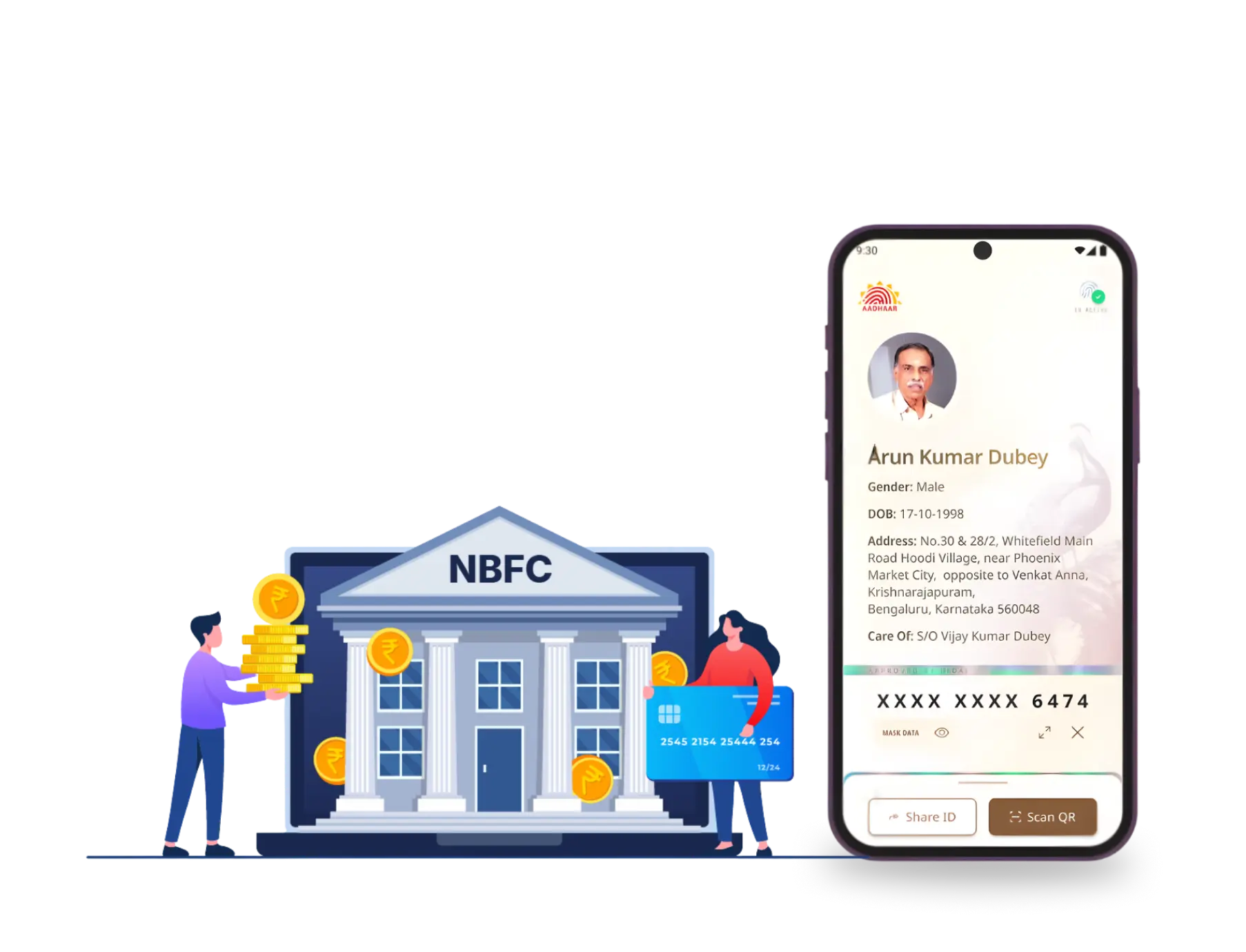

Surepass, a Technical Service Provider, helps NBFCs in managing Aadhaar offline KYC operations by providing Technical Assistance and system-level support for:

- Customer onboarding workflows

- QR-Based OKYC Verification

- Compliance Support

- Audit and Logs

With the right technical workflows, you can onboard customers in seconds with Aadhaar OKYC and ensure only genuine individuals access services.

Benefits of Aadhaar Offline KYC for NBFCs

- Eliminates the need for physical documentation

- Make the onboarding and verification process faster

- No time-consuming manual verification is required

- Selective sharing of information reduces sensitive data exposure

Benefits of Verifying with our API

Plug and Play

The solution is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent identity fraud, impersonation, and unauthorized access by verifying customers through secure QR-based authentication.

Accurate and Reliable

Our system checks the information. Therefore, the results are always correct and legitimate.

Blog

How Aadhaar Face Scan Authentication Works in the New Aadhaar App?

What is Aadhaar Offline KYC for NBFCs?

How does offline KYC Work?

Can I integrate the solution with the existing business system?

What are the benefits of Aadhaar Offline KYC for Banks?

Does it store Aadhaar details of an individual?

Do users need to submit a physical Aadhaar card for verification?

Driving License API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More