Introduction

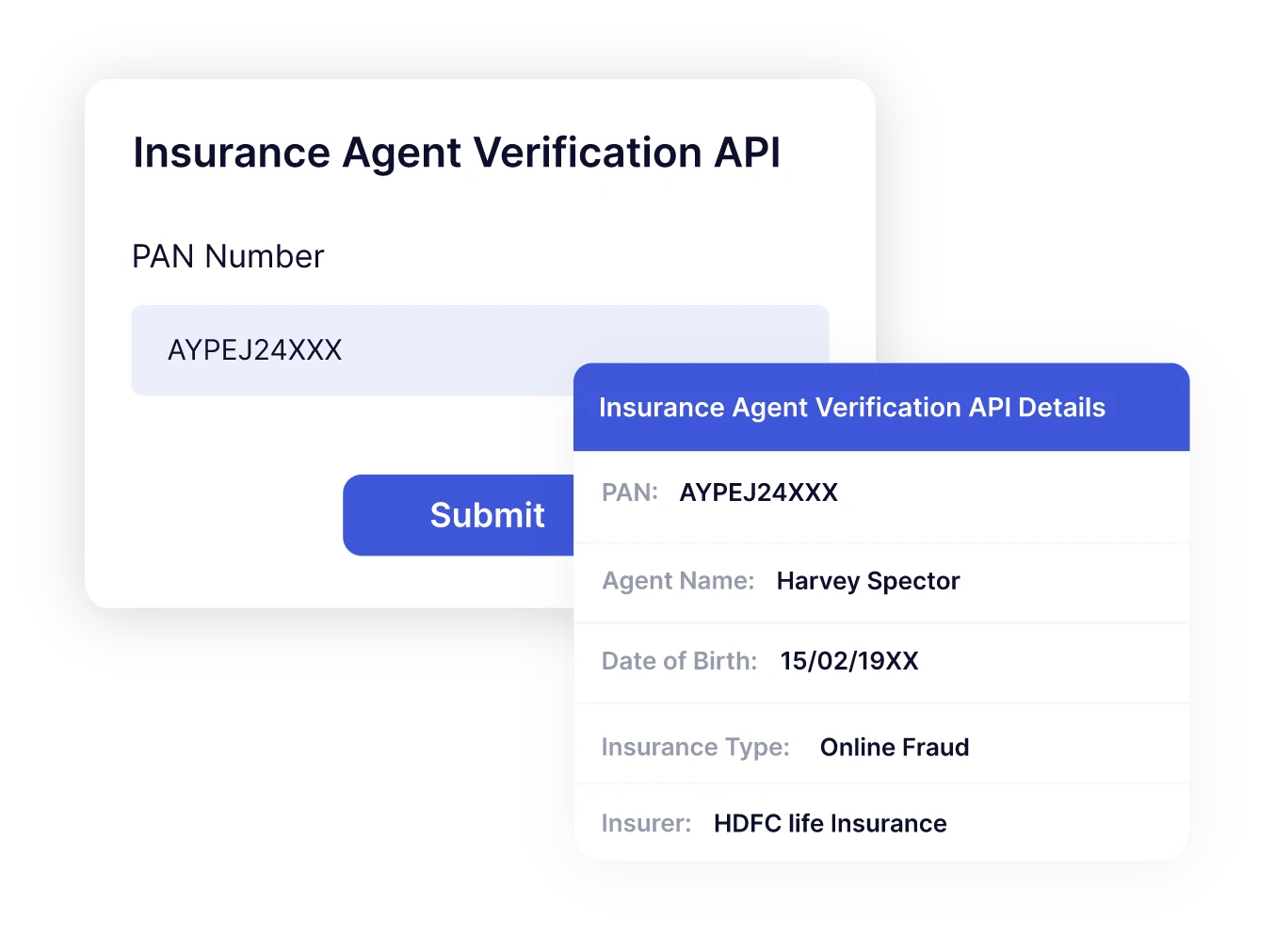

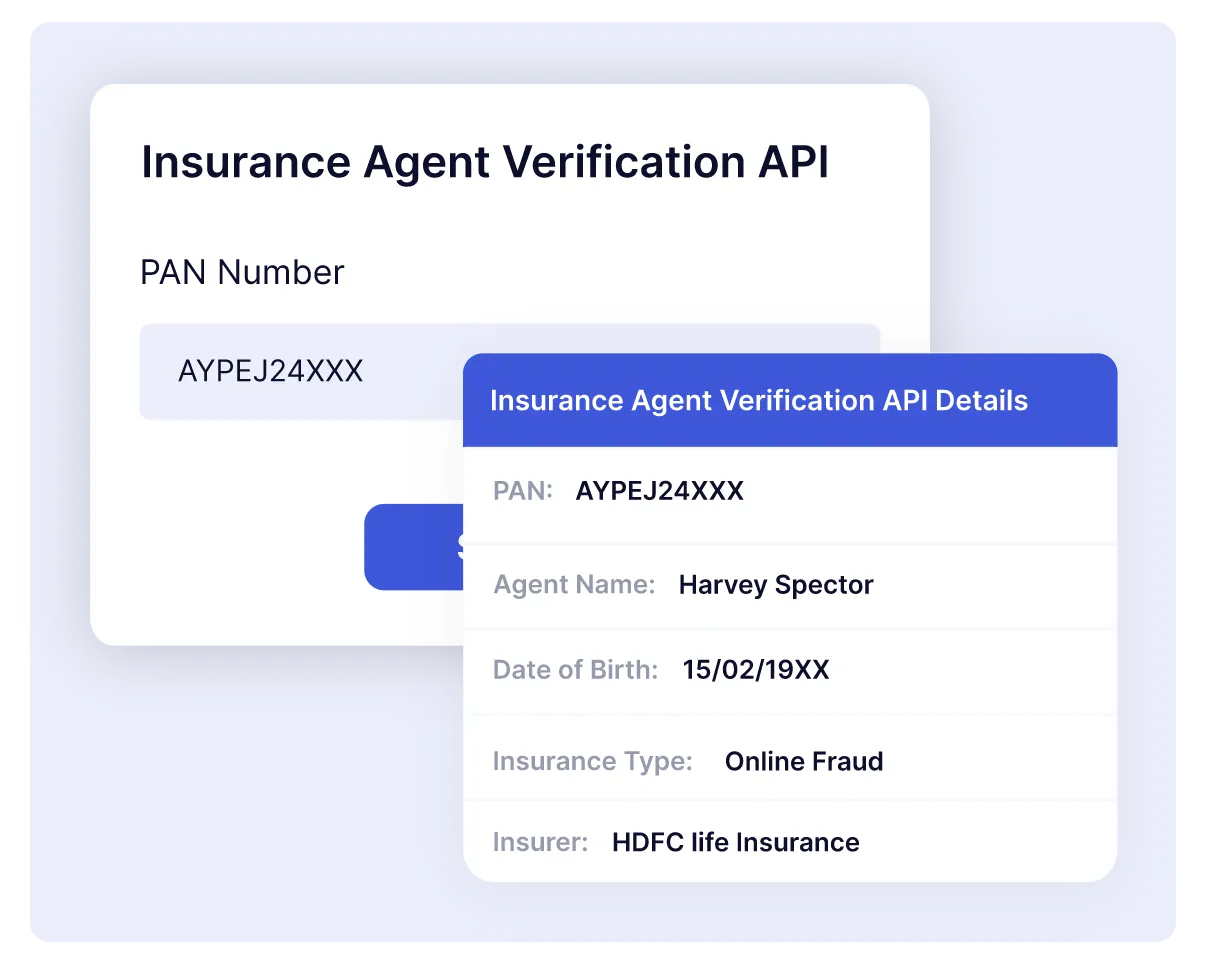

Surepass’s API streamlines the verification process by requiring insurance agents to provide PAN card details or clear photocopies for verification. The system then conducts an IRDA PAN check to confirm the existence and legitimacy of the agent’s information in the IRDA database.

This thorough verification process enhances trust and reliability in the insurance industry, allowing companies to make informed decisions regarding agent partnerships and ensuring compliance with regulatory requirements.

By offering comprehensive reports generated through IRDA PAN lookup checks, Surepass’s Insurance Agent Verification API facilitates quick decision-making for insurance companies.

Benefits of Verifying with our API

Plug and Play

The Insurance Agent Verification API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Surepass’s API prevents fraud by verifying insurance agents’ credentials against the IRDA database, ensuring legitimacy and reducing fraudulent activities.

Accurate and Reliable

Surepass’s Insurance Agent Verification API guarantees accuracy and reliability by cross-referencing credentials with the IRDA database using IRDA PAN lookup.

case-study

How SurePass helped in verifying customers for a used two wheeler seller of India

How does the Insurance Agent Verification API work?

What information is required for agent verification through the API?

Is the Insurance Agent Verification API compliant with regulatory standards?

How quickly can insurance companies receive verification results?

Can the API be integrated into existing systems?

What measures are in place to ensure data security and privacy?

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More