Introduction

What is CRILC?

The CRILC full form is the Central Repository of Information on Large Credits, it is a centralized database developed by RBI. It collects, stores and shares the data of borrowers on credit exposure.

CRILC helps track SMAs (Special Mention Accounts) and identify stressed borrowers to reduce NPAs (Non-Performing Assets).

The Surepass CRILC Data API helps businesses in getting comprehensive CRILC reports. This solution fetches details on borrower credit exposure, including aggregate fund-based and non-fund-based limits. Real-time access to comprehensive data improves the evaluation process and decision-making, reducing the risk of defaults.

Key Advantages of using CRILC Data API

- Simplify Credit Monitoring: Gives quick access to borrower data and helps identify the potential risk of defaults.

- Enhanced Decision Making: Comprehensive data helps in informed decision-making in lending.

- Reduce NPAs: The early identification of the stressed borrower will reduce the risk of Non-performing assets.

Industries That Will Get Benefit

- Banks and Financial Institutions: Banks can use this CRILC Data API to streamline the credit assessment process. This will help in the early identification of stressed borrowers and reduce the NPAs.

- Lending Platforms: Online Lending Platforms can use this API to evaluate the creditworthiness of the borrower, thereby reducing the risk of defaults.

- Insurance Companies: Insurance companies can use this API to evaluate the financial condition of borrowers applying for insurance. This will reduce the risk of underwriting policies for high-risk borrowers.

- Credit Rating Agencies: Credit Rating Agencies can use the CRILC Data API to get data for proper analysis of borrower financial health. This will help in assigning accurate ratings and predictions of risk associated with large borrowers.

Benefits of Verifying with our API

Plug and Play

The API is straightforward and integration is effortless, We provide a simple and user-friendly interface.

Prevent Fraud

Prevent the risk of defaults and financial loss with real-time CRILC reports from the Surepass CRILC Data API.

Accurate and Reliable

Our system checks the information from the board department. Therefore, the results are always correct and legitimate.

Blog

What Is Aadhaar Verification API, Why Use It?

What is CRILC Data API?

How to use CRILC Data API?

How accurate is CRILC Data API?

How do I integrate this Data API?

How long does the API take to fetch the report?

Can the API Handle Bulk Data Processing?

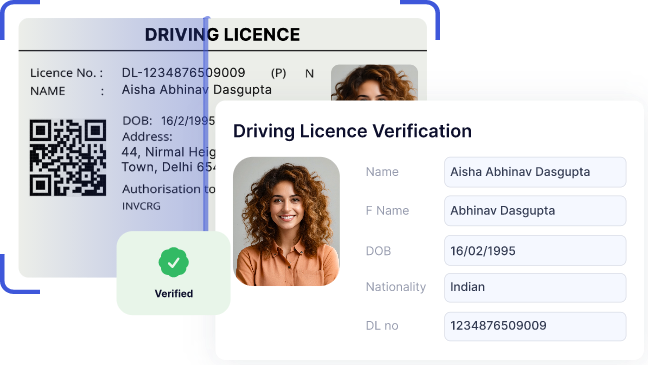

Driving License Verification API

Driving License Verification API is an extremely important identity. It proves that you are eligible, fit and trained to drive a particular category of vehicle.Driving License also works as an ID to verify a person’s signature.

Read More

Voter ID Verification API

Voter ID verification API is an important process for every institution or the entities that need an API for Voter Card verification. This is the most basic identity that is needed everywhere.

Read More