UTR Number holds significant importance in online banking. It acts as proof of payment confirmation and ensures compliance with financial regulations. It helps track payments, verify transaction statuses, and resolve discrepancies. You can find this number from the online payment statement and the bank statement. In this guide, you will learn about the UTR Number in detail. So, stay tuned until the end.

What is the UTR Number?

UTR is a unique identifier assigned to each transaction. It is commonly used for NEFT, RTGS, and IMPS transactions. Its full form is a unique transaction reference number. It is made up of is 12 to 22 alphanumeric characters that include the bank code, transaction date, and a unique serial number. It helps track, identify, and resolve issues related to transactions.

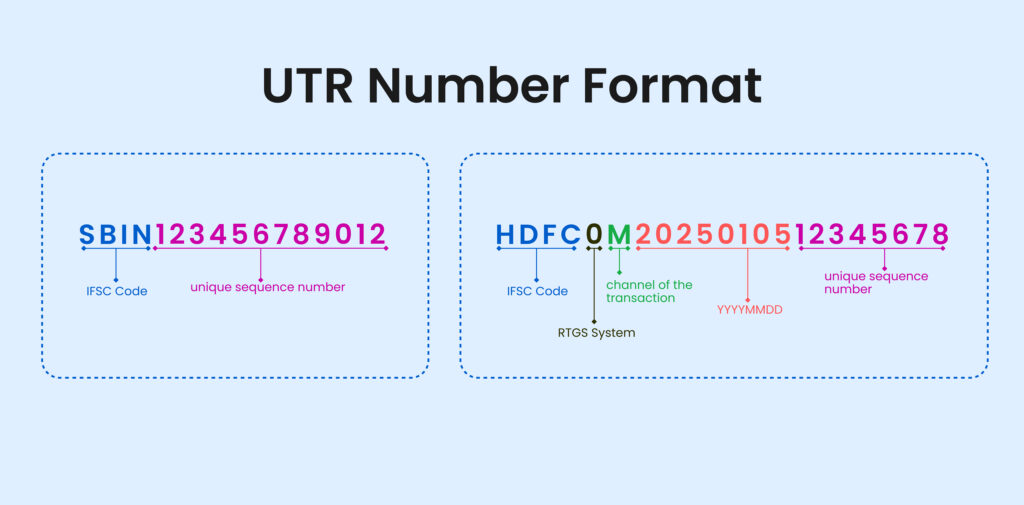

Structure of UTR Number

It is a well-structured code, usually, it has 22 alphanumeric characters for RTGS transactions, 16 characters for NEFT, while for IMPS transactions, it contains 12 characters.

UTR Format

NEFT Format (16 Characters): Ex: SBINR24031012345678

- The first 4 Characters represent the IFSC code of the sender’s bank.

- N: It represents the NEFT System.

- YY: The Next two characters represent the year of the transactions.

- DDD: The Next three characters represent the day of the year.

- 6 digits: The Last 6 characters are a unique sequence number.

RTGS Format (22 Characters): Ex: HDFC0M2025010512345678

- XXXX: The First four characters represent the IFSC code.

- R: It indicates the transaction was processed through the RTGS system.

- C: Represents the channel of the transaction (e.g., internet banking and mobile banking).

- YYYMMDD: The Next eight characters represent the year, month, and date of the transaction.

- 8 Digits: The Last eight characters are a unique sequence number.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

How to Check UTR Number?

As we know, UTR number is assigned to each bank transaction; in some cases, the recipient did not receive the payment. You can show this number as proof of the transaction. You can check or find this unique identifier through the following methods:

From Bank Statement or Passbooks:

- Get your bank statement or passbook.

- Find the specific transaction by checking the details like date, amount, and reference number.

- Find the UTR number under labels like “Reference Number,” UTR Number, or “Unique Transaction Reference.”

Internet Banking

- Log in to your banking portal.

- Visit the transaction history or account statement section.

- Select any transaction you want to track.

- Click on View detailed information.

- UTR will be displayed in the transaction details.

- Find the UTR, reference number, or transaction ID.

Mobile Banking

- Log in to the Mobile Banking App.

- Select the transaction.

- Find the UTR number.

In Emails and SMS (Transaction Confirmation)

- Check your SMS and Email inbox.

- Find the UTR Number.

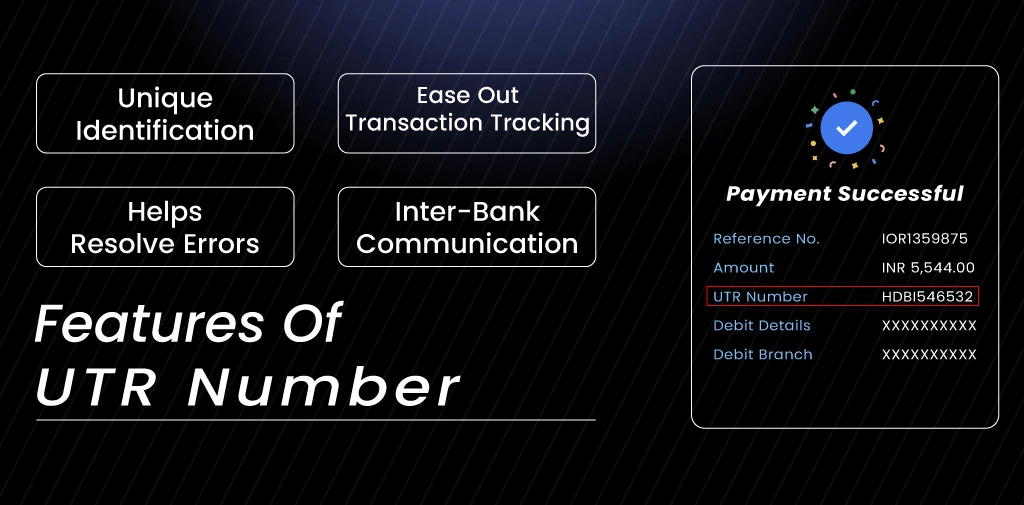

Features of UTR Number

- Unique Identification: It is a unique set of numbers, and a new UTR is assigned to each transaction.

- Ease out transaction tracking: It helps track the status of NEFT, RTGS, and IMPS transactions.

- Helps in resolving errors: The UTR helps resolve transaction disputes, such as failed transactions or delayed payments.

- Inter-Bank Communication: They facilitate communication between banks about a specific transaction.

- Wide Applicability: It is used in various payment systems like RTGS, NEFT, and IMPS.

How to Track a UTR Number Online?

You can track the status of the transaction through the following methods:

Follow these simple steps to track UTR numbers online:

- Log into the Bank’s Internet Banking portal or mobile app.

- Go to the transaction tracking or payment status section.

- Enter the UTR and initiate the search to check the transaction status.

Contact Customer Support

- Call the bank customer care number or use their chat support features.

- Provide the UTR and transaction details (date, amount, recipient, bank account).

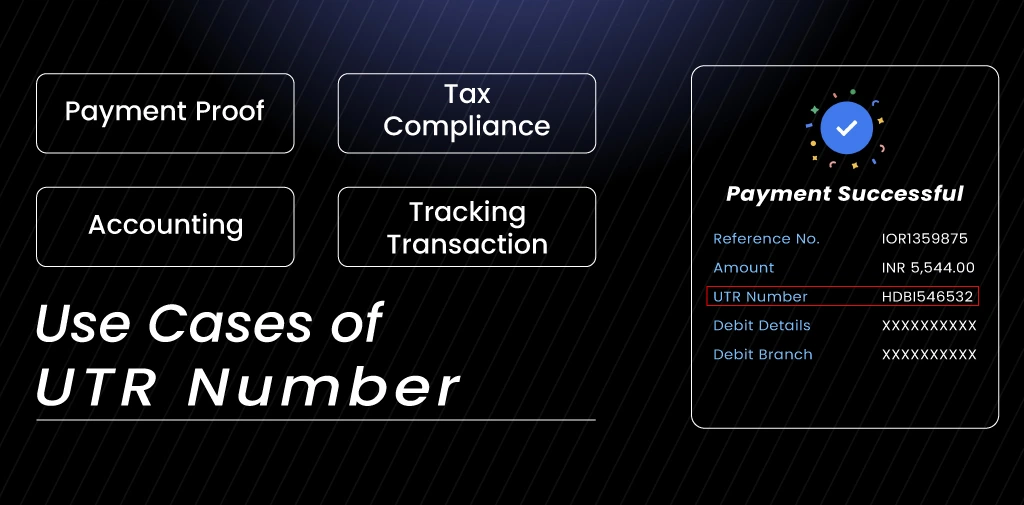

Use Cases of UTR Number

UTR Numbers can be used for various purposes:

- Payment Proof: It is proof of payment for transactions like property purchases, loan settlements, or business dealings.

- Tax Compliance: Tax authorities require a UTR when filing income tax returns. This helps in the verification of reported income and financial transactions. It will help in fraud prevention and tax evasion.

- Accounting: Banks use UTR to maintain clear records of monetary transactions.

- Tracking Transaction: It simplifies the tracking of transactions, benefiting both banks and customers. They provide a detailed record of the transaction journey from initiation to completion. The tracking helps in accurate fund transfers with minimal errors. It will confirm that the payment reaches to right recipients.

Conclusion

The UTR number is a unique set of alphanumeric codes assigned to each transaction. It helps track and verify transactions from initiation to completion. In case of transaction disputes, you can use this number to use as proof of payment. You can follow the above methods and steps to track and find your UTR.

FAQs

How to Find UTR Number?

You can find the UTR in the transaction history section on the bank statement.

What is a 12-digit UTR Number?

A 12-digit UTR is a unique code assigned to each electronic transaction in India.

How can I check the UTR Number?

You can check the UTR through the bank statement, mobile app, or internet banking in the transaction details. It can also be found in transaction confirmation emails or SMS notifications.

What is the Full Form of the UTR Number?

UTR full form is Unique Transaction Reference Number.

How to find the UTR Number for UPI Transactions?

Follow these steps to check the UTR:

- Open UPI App.

- Go to the transaction history section.

- Find and select the transaction.

- Look for the UTR in the transaction details.