Do you know that around 400 million people use UPI for online payments regularly? Do you also know that lakhs of fake payment UPI cases are registered annually? These numbers are rising day by day, which is alarming for UPI users. It is important to be aware, because you can be the next target of the fraudster.

Whether you are using PhonePe, Google Pay, BHIM, or any other App, be careful. Because you can lose money without notice. Check the Apps and match the transaction with the bank statement for payment confirmation. If you are not aware of fake payment UPI scams and preventive measures, read the blog until the end.

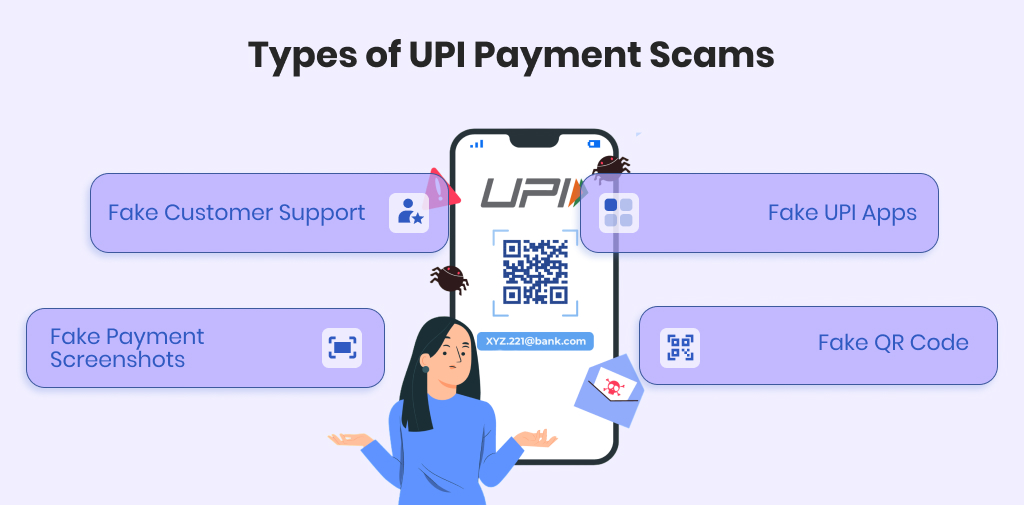

Types of UPI Payment Scams and How to Identify Them (With Real Cases)

In fake payment UPI scams, fraudsters trick people who have done the UPI transaction. But in reality, no money is received by the person. To prevent this, you need to identify the types of scams:

Fake Payment Screenshots

In this Scam, a fraudster sends a photoshopped image of a payment screenshot. The recipient thought that he received payment, but actually, no payment was credited.

Real Case

Vakola police arrested 3 Men for sharing a fake payment screenshot on a luxury hotel booking. The hotel management found this scam by comparing bill amounts. The management found discrepancies and discovered that money had not been deposited into the bank account.

How to identify:

- No SMS/Email from your bank confirming payment.

- A fake payment screenshot may have a visible sign of editing.

- Always check your UPI or verify your bank account before confirming receipt.

Automate your KYC Process & reduce Fraud!

We have helped 200+ companies in reducing Fraud by 95%

Fake UPI Apps

In this scam, scammers create clone apps that look similar to UPI apps (Phonepe, BHIM Pay, Google Pay, etc). When people make the transaction on it, they lose their login credentials and sensitive financial information.

Real Case

Two youngsters from Faridabad and Bareilly – Samarth Singh and Chanayka Alias Aadi Gupta – have been arrested for using a cloning app to make fake transactions to support a lavish lifestyle. The mastermind, Yuvraj Singh Chauhan, is on the run. It is not clear whether they have created the fake payment UPI App replica or bought it from somewhere. They mainly targeted busy vendors and mall shop owners who rarely check payment confirmations.

How to identify

- Check the app before installing and downloading, and also read the reviews before downloading.

Fake QR Code

In this Scam, the Scammer changed the original QR code or swapped it with a tampered one to obtain money illegally.

Real Case

In Khajuraho, Madhya Pradesh, fraudsters changed the QR code of shops and petrol pumps with a tampered QR Code overnight. This QR code redirects people to pay scammers’ bank accounts instead of the petrol pump or the shop owner. This fraud comes to light when a customer notices that while scanning a QR code, a different name is displayed instead of the shop’s name. When the shop owner checked the CCTV, he found out that someone had changed the QR code.

How to Identify a QR Code Scam?

- Check the name before paying. If you are not sure about the name, ask the shopkeeper for confirmation.

- If there is an urgency for the payment, take a moment to verify.

Customer Support Frauds

In a customer support fraud scam, fraudsters impersonate themselves as customer care agents from banks, tech companies, or other services. They convince people to share their sensitive information and OTP. They get access to their device.

How to Identify

- Remember that the customer care person never calls with a suspected number and asks for OTP.

- They can use various tactics to create urgency.

SIM Cloning

Fraudsters duplicate your SIM card to intercept OTPs and access your UPI account, leading to unauthorized transactions.

How to Identify?

- You will lose your mobile network for no reason.

- You will not receive OTPs, Calls, and messages.

- You may receive unusual transactions or login alerts.

Screen Sharing Scam

In this scam, people are convinced to download the screen-sharing apps. They don’t have any idea that someone has access to their phone. When they do online transactions, the scammer gets their PINS and takes advantage of them.

How to Identify?

- Any request to install a screen-sharing app is a red flag.

- The caller insists that it’s for helping with a payment or technical issue.

Fraud Sellers: On some platforms, fake sellers ask for an advance payment. After receiving money, it will disappear. However, even after sending money, the buyer does not receive any item.

How to Identify:

- The seller will ask for advance payment before delivery.

- No proper contact details, websites, or reviews are available.

How to Prevent UPI Payment Scams?

Follow these prevention tips you must know to prevent fake payment UPI fraud.

- You must check your bank account to confirm payment.

- Never trust payment screenshots as proof of payment.

- Download apps from the official app stores (Google Play Store or Apple App Store)

- Carefully check the transaction ID, timestamp, payment amount, and sender details before making a payment.

- Avoid scanning QR codes or making payments from unknown or suspicious sources.

- Don’t share OTP, PIN, or personal information over calls.

- Don’t call on customer care number that is directly available on Google.

- Install antivirus or security apps on your phone and computer. It helps detect screen-sharing or spying apps.

- Set transaction limits on UPI to reduce financial loss.

How to Report Payment Fraud?

- Immediately Contact Your Bank: Contact your bank or financial institution and report the fraudulent transactions.

- Report to the National Cybercrime Reporting Portal: You can report cyber financial fraud through the Indian Cybercrime Coordination Centre (14C).

- Call on National Helpline Number: Report cyber financial frauds by calling the National Helpline Number 1930.

- Report to RBI Sachet (for Cybercrimes): You can file a complaint through the RBI Sachet.

- Sanchar Saathi: If you receive a fraudulent call for your bank account details or wallet, call Sanchar Saathi.

Conclusion

As Fake Payment UPI cases are increasing, it’s become essential for individuals to be aware of these cases. You must know about the types of payment fraud. This will help you identify suspicious transactions and help you prevent them. It is good for you to be careful while making payments and always verify the UPI ID. Secure your device with antivirus and security apps, so no one can get access to your sensitive information. However, in case you get scammed, you can report to the Bank and the Cybercrime Portal.

FAQs

What should I do if I receive a fake UPI Payment Screenshot?

Verify and match the payment in your UPI app or bank account. If it is a fake screenshot, report to the bank and the Cybercrime Portal.

What is the safest way to confirm a UPI Payment?

Check the:

- Official UPI Apps.

- Bank SMS alerts.

- Bank account balance or transaction history.

Where to report UPI Fraud?

You can report to the bank, Cybercrime Portal, Helpline 1930, and RBI Sachet Portal.

How to Identify a Fake Payment UPI Scam?

You can spot a fake UPI payment Scam by verifying the transaction ID, timestamp, payment amount, and sender details.

Ashish Kesharwani

More posts by Ashish Kesharwani